Interest rates for different terms forecast to drop 0.5-1 percent

Interest rates for different terms from now to the end of 2017 are likely to decline by 0.5–1 percent from 2016 thanks to positive signals from the stock and property markets, macro-economic indexes, the Government’s attentions to businesses and banks’ strategies for attracting new clients.

Interest rates for different terms from now to the end of 2017 are likely to decline by 0.5–1 percent from 2016 (Photo: VNA)

Interest rates for different terms from now to the end of 2017 are likely to decline by 0.5–1 percent from 2016 (Photo: VNA)Hanoi (VNA) – Interest rates for different terms from now to the end of 2017 are likely to decline by 0.5–1 percent from 2016 thanks to positive signals from the stock and property markets, macro-economic indexes, the Government’s attentions to businesses and banks’ strategies for attracting new clients.

Lawyer Bui Quang Tin from the business administration faculty of the Banking University of Ho Chi Minh City made the prediction at the Vietnam Economic Forum 2017 held by the Party Central Committee’s Commission for Economic Affairs in Hanoi on June 27.

There will be more challenges to stabilise interest rates in the remaining months of 2017 compared to 2016 as inflation and interest rates are expected to increase because the US Federal Reserve is projected to make at least three interest rate hikes this year, he said.

Also, bad debts haven’t been thoroughly settled, causing a big barrier to the lowering of interest rates, Tin said, adding that the fact will pose bigger pressure on deposit rate hikes.

In the first quarter of 2017, deposit rates for different terms rose by several tens of basis points at some small and medium-sized banks. However, the whole banking system’s deposit rates basically did not change much from the year’s beginning.

[Banking sector sees 6.53 percent in credit growth]

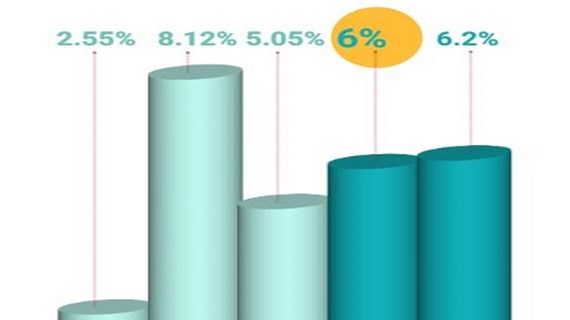

Deposit rates for under-six-month terms were kept below the ceiling rate of 5.5 percent per annum, mostly between 4.3–5.5 percent. The rates were about 5.3–7 percent for the terms of from six months to under 12 months, and 6.5–8 percent per annum for the terms of 12 months upwards.

Meanwhile, lending rates were relatively stable. In prioritised areas, the rates ranged between 6–7 percent per annum for short terms and 9–10 percent for medium and long terms. The respective rates were 6.8–9 percent and 9.3–11 percent per annum for loans in normal production and business areas.

The recent augmentation of deposit rates at some banks is attributed to their need to increase capital and meet capital adequacy ratio requirements. The shortage of liquidity, high inter-bank interest rates which have hampered some banks’ access to capital sources in the inter-bank market, and better credit growth were also reasons behind banks’ move to attract more deposits.

However, the pressure to increase deposit rates only occurs at some banks, and the liquidity shortage did not happen at major banks. The State Bank of Vietnam still has room to regulate the market and ensure low interest rates to support growth.

To stabilise lending rates, Tin suggested that the banking system should step up settlement of bad debts and restructuring of credit institutions. The difference between interest rates for loans and deposits in USD and VND should also be kept at reasonable levels, he added.-VNA