NA discusses revising Civil Code, civil rights

Top lawmakers agreed that it was necessary to have a regulation on protecting civil rights through an authorised agency when discussing the revised Civil Code on October 15.

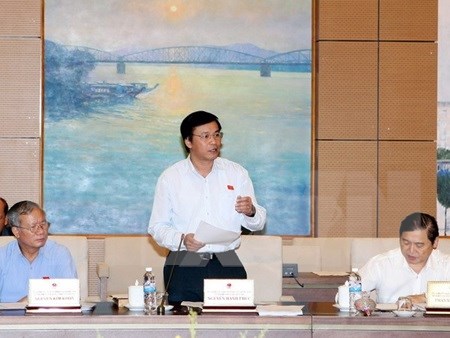

Chairman of the National Assembly Office Nguyen Hanh Phuc speaks at the 13th National Assembly (NA) Standing Committee held on October 15. (Photo: VNA)

Chairman of the National Assembly Office Nguyen Hanh Phuc speaks at the 13th National Assembly (NA) Standing Committee held on October 15. (Photo: VNA)Speaking at the discussion session on the fourth day of the on-going 42th National Assembly’s Standing Committee meeting, the National Assembly (NA) deputies said that the move would help institutionalise the national Constitution's regulations on protecting and ensuring human rights and citizens' rights.

The revised Civil Code, one of the most important laws in Vietnam's legal framework, is expected to be approved at the upcoming month-long 10th National Assembly meeting by the end of this month.

The standing committee deputies also agreed that gender transformation would be conducted following laws and transgender individuals had the right and obligation to register for changes in personal records as well as personal rights in accordance with their gender under relevant laws.

At the meeting on October 15, lawmakers decided to drop the stipulation that the full name of an individual must not exceed 25 letters, saying that the regulation limited human rights.

Debate was heated when discussing the interest rate in contracts for property loans as the law compiling board proposed keeping the basic interest rate for reference while the examining board wanted to use the fixed interest rate instead.

Some others proposed to use the re-financing interest rate, inter-bank interest rate, Government bond interest rate or interest rate of some large commercial banks for reference.

Chairman of the NA's Finance and Budget Committee, Phung Quoc Hien, said that using the fixed interest rate was a good choice but also noted that in case of high inflation, the leaser would suffer losses due to currency devaluation.

Meanwhile, Deputy Minister of Finance Dinh Trung Tung disagreed, saying that the previous civil codes ratified in 1995 and 2005 all used the basic interest rate.

Tung agreed with Hien on the point that using a fixed interest rate would not be flexible in the case of increasing inflation but the law cannot follow.

Facing different opinions, NA Chairman Nguyen Sinh Hung asked the compiling board and the examining board to carefully consider and discuss further before submitting to the NA meeting.-VNA