Real estate value drops off in Q2

The value of the country's real estate currently on sale on the market

at the end of June was roughly 108.77 trillion VND (5.06 billion USD),

down 15.4 percent against the first quarter, said Deputy Minister of

Construction Nguyen Tran Nam.

The value of the country's real estate currently on sale on the market

at the end of June was roughly 108.77 trillion VND (5.06 billion USD),

down 15.4 percent against the first quarter, said Deputy Minister of

Construction Nguyen Tran Nam.

Nam said that 27,805 high rise apartments worth 41.54 trillion VND (1.93 billion USD) are currently available, accounting for 38.19 percent of the country's total housing stock.

There are also more than 2 million square metres of land plots on the market, Nam disclosed at a meeting in the capital on August 9 of the Central Steering Committee on Housing Policy and Real Estate Market.

Nam said that these figures were inadequate as several cities and provinces have not yet provided accurate figures but the data provided from 56 out of 63 cities and provinces nationwide.

Ho Chi Minh City and central Khanh Hoa Province were the areas to record the biggest drop in available real estate.

The value of unsold real estate in Ho Chi Minh City at the end of June had fallen to roughly 26.69 trillion VND as city-based property developers sold an additional 1,877 apartments in the first half of the year.

In Hanoi , there were 9,651 apartments and houses available, up 3,862 units against December last year. The total value came to more than 17 trillion VND.

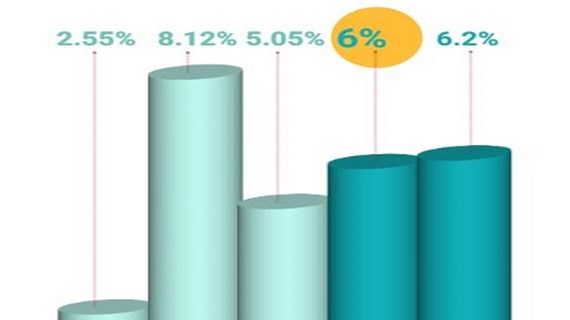

During the meeting on August 9, the State Bank of Vietnam also reported that total outstanding loans to the real estate industry in the first half of this year rose by 4 percent against December last year to reach 237.5 trillion VND (11.04 billion USD).

Of the total, lending to industrial and processing zones came to 14.96 trillion VND, up 0.1 percent. Loans to residential urban developers were 46.68 trillion VND while 55.84 trillion VND was allocated for purchasing houses and repairs.

However, the central bank noted that non-performing loans in the real estate sector stood at 6.53 percent at the end of June, against 5.39 percent in December last year.

As for the 30 trillion VND housing stimulus package, the central bank said that it would pay more attention when carrying the programme, out as currently it is difficult for individual borrowers to access the package that offers the preferential interest rate of 6 percent per year.-VNA

Nam said that 27,805 high rise apartments worth 41.54 trillion VND (1.93 billion USD) are currently available, accounting for 38.19 percent of the country's total housing stock.

There are also more than 2 million square metres of land plots on the market, Nam disclosed at a meeting in the capital on August 9 of the Central Steering Committee on Housing Policy and Real Estate Market.

Nam said that these figures were inadequate as several cities and provinces have not yet provided accurate figures but the data provided from 56 out of 63 cities and provinces nationwide.

Ho Chi Minh City and central Khanh Hoa Province were the areas to record the biggest drop in available real estate.

The value of unsold real estate in Ho Chi Minh City at the end of June had fallen to roughly 26.69 trillion VND as city-based property developers sold an additional 1,877 apartments in the first half of the year.

In Hanoi , there were 9,651 apartments and houses available, up 3,862 units against December last year. The total value came to more than 17 trillion VND.

During the meeting on August 9, the State Bank of Vietnam also reported that total outstanding loans to the real estate industry in the first half of this year rose by 4 percent against December last year to reach 237.5 trillion VND (11.04 billion USD).

Of the total, lending to industrial and processing zones came to 14.96 trillion VND, up 0.1 percent. Loans to residential urban developers were 46.68 trillion VND while 55.84 trillion VND was allocated for purchasing houses and repairs.

However, the central bank noted that non-performing loans in the real estate sector stood at 6.53 percent at the end of June, against 5.39 percent in December last year.

As for the 30 trillion VND housing stimulus package, the central bank said that it would pay more attention when carrying the programme, out as currently it is difficult for individual borrowers to access the package that offers the preferential interest rate of 6 percent per year.-VNA