Sacombank shareholders greenlight merger

Sacombank shareholders has agreed to the bank's plan to merge with

Southern Bank which will be implemented this year if the feasibility

study is approved by the authority and shareholders.

Sacombank shareholders has agreed to the bank's plan to merge with

Southern Bank which will be implemented this year if the feasibility

study is approved by the authority and shareholders.

Addressing the annual shareholders' meeting on March 25, newly-appointed chairman Kieu Huu Dung said the merger would help the bank increase its competitive advantage, expand operations and have more resources to carry out future business plans.

The management board has been tasked with compiling the feasibility study to submit to the authority and shareholders.

Sacombank (STB) on March 25 reported pre-tax profit of nearly 2.84 trillion VND (134.5 million USD) last year, surpassing its yearly goal by 1.3 percent and up 115.9 percent against 2012.

Including profits from the bank's subsidiary units, total pre-tax profit reached over 2.96 trillion VND (140.3 million USD), an increase of 116.4 percent over the previous year.

The bank's vice chairman, Nguyen Mien Tuan, said the bank had reached its profit target despite losses incurred from closing gold accounts following the central bank's regulation.

Tuan said most business targets rose over the previous year, of which charter capital was up 15.7 percent to 12.425 trillion VND (588.7 million USD), while total assets increased 5.9 percent to 160.17 trillion VND (7.6 billion USD).

At the end of last year, deposits totalled 140.77 trillion VND (6.67 billion USD), up 13.8 percent, and total outstanding loans reached nearly 110.3 trillion VND (5.22 billion USD), up 13.7 percent. The bank's bad debt ratio was low at 1.44 percent.

The bank will pay shareholder dividends at 18 percent, of which 8 percent was already paid in cash last year.

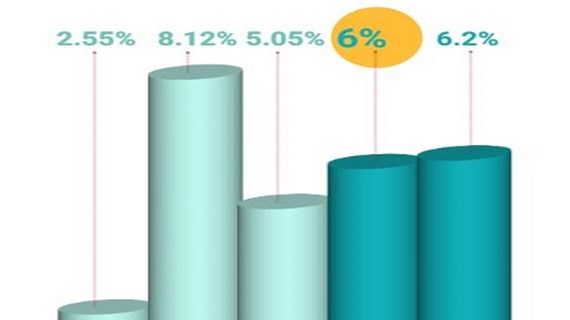

This year, the lender has set a profit target of 3 trillion VND (142.2 million USD), up 6 percent over 2013; total assets of 183 trillion VND (8.71 billion USD), up 14 percent; total deposits of 160.5 trillion VND (7.64 billion USD), up 14 percent; and total outstanding loans 124.6 trillion VND (5.9 billion USD), up 13 percent.

It projects a dividend rate of 10-12 percent of charter capital and plans to limit bad debt to under 3 percent.-VNA

Addressing the annual shareholders' meeting on March 25, newly-appointed chairman Kieu Huu Dung said the merger would help the bank increase its competitive advantage, expand operations and have more resources to carry out future business plans.

The management board has been tasked with compiling the feasibility study to submit to the authority and shareholders.

Sacombank (STB) on March 25 reported pre-tax profit of nearly 2.84 trillion VND (134.5 million USD) last year, surpassing its yearly goal by 1.3 percent and up 115.9 percent against 2012.

Including profits from the bank's subsidiary units, total pre-tax profit reached over 2.96 trillion VND (140.3 million USD), an increase of 116.4 percent over the previous year.

The bank's vice chairman, Nguyen Mien Tuan, said the bank had reached its profit target despite losses incurred from closing gold accounts following the central bank's regulation.

Tuan said most business targets rose over the previous year, of which charter capital was up 15.7 percent to 12.425 trillion VND (588.7 million USD), while total assets increased 5.9 percent to 160.17 trillion VND (7.6 billion USD).

At the end of last year, deposits totalled 140.77 trillion VND (6.67 billion USD), up 13.8 percent, and total outstanding loans reached nearly 110.3 trillion VND (5.22 billion USD), up 13.7 percent. The bank's bad debt ratio was low at 1.44 percent.

The bank will pay shareholder dividends at 18 percent, of which 8 percent was already paid in cash last year.

This year, the lender has set a profit target of 3 trillion VND (142.2 million USD), up 6 percent over 2013; total assets of 183 trillion VND (8.71 billion USD), up 14 percent; total deposits of 160.5 trillion VND (7.64 billion USD), up 14 percent; and total outstanding loans 124.6 trillion VND (5.9 billion USD), up 13 percent.

It projects a dividend rate of 10-12 percent of charter capital and plans to limit bad debt to under 3 percent.-VNA