Vietnam's IPOs underwhelm this year

Vietnam's initial public offering (IPO) activity has been less than exciting in 2015 and that has been attributed to the lack of blockbuster deals.

Illustration photo. (Source: VNA)

Illustration photo. (Source: VNA)A wave of State-owned giants offered their shares to the public in deals worth over 1 trillion VND (44.4 million USD) each last year. These included the national flag carrier Vietnam Airlines, the Vietnam National Textile and Garment Group (Vinatex) and Ca Mau Fertiliser, a subsidiary of energy giant PetroVietnam.

2015 is drawing to a close soon, but so far, only the IPO from the Airports Corporation of Vietnam on December 10 collected 1.1 trillion VND (49 million USD). Several most-anticipated share offerings have missed the deadline this year.

The holdup in the equitisation of the mobile network operator MobiFone has disappointed investors.

As planned, MobiFone should have announced its value assessment by the third quarter and implemented the IPO in the last quarter of this year. But to date, such information has not been declared, except the news that it has selected brokerage firm Ban Viet Securities as a consultant for its equitisation.

Last month, Minister of Information and Communications Nguyen Bac Son asked the company to submit reports on the equitisation progress weekly to the Corporate Management Department and monthly to ministry officials for effective implementation.

Son said a number of international telecommunications firms from Australia, France, Malaysia and Singapore have expressed interest in a strategic partnership with the company in the past months but gave no further details.

According to the ministry, MobiFone currently has a charter capital of 15.3 trillion VND, or 680 million USD. In 2014, HCM City Securities Company valued MobiFone at 3.4 billion USD, which may reach beyond 4 billion USD after the IPO.

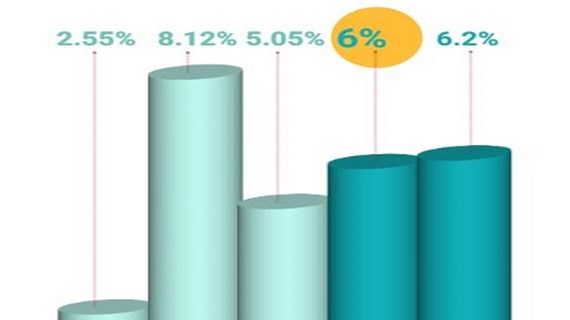

MobiFone Chairman Le Nam Tra said that in the first 10 months of this year the company's profit has nearly reached the annual target while its turnover has grown by 7.8 percent year-on-year. It planned to earn 36.4 trillion VND (1.6 billion USD) in total revenue and 7.3 trillion VND (324.4 million USD) in profit in 2015.

Another State-owned enterprise, which failed to launch its IPO this year, is the Vietnam National Shipping Lines, better known as Vinalines.

In late 2014, CEO Vinalines Le Anh Son confirmed that the shipping company would implement the share offering to the public in the first quarter of 2015. However, after two delays in the second quarter and the third quarter, it has not yet made it even as the year draws to a close.

Son attributed the delay to the lengthy time of settling the company's debts which still stood at more than 7 trillion VND (311 million USD).

According to the equitisation scheme, Vinalines has a charter capital of 9.1 trillion VND (404 million USD), of which the State will retain 36 percent of stakes, strategic investors will hold 30 percent and the other 33.75 percent of shares will be sold to the public.

Earlier this year, Vietnam's budget carrier VietJet Aviation Joint Stock Company also announced its plan of launching the IPO within this year in a deal which could reach 800 million USD.

The IPO timing had been rescheduled from October to the end of this year, but it might break its promise again.

Vietjet has 30 Airbus A320S and A321S jets on its fleet. In August, the airline's managing director Luu Duc Khanh said the company earned more than 5.7 trillion VND (253 million USD) in the first six months of this year, a 205 percent increase year-on-year.

According to Minister of Finance Dinh Tien Dung, about 210 State-owned enterprises will be equitised by the end of this year, which is short of the target of 289.-VNA