Banks expect higher profits from recovery

Many banks have planned higher profits this year as they expect better recovery in the economy.

Many banks have planned higher profits this year as they expect better recovery in the economy.

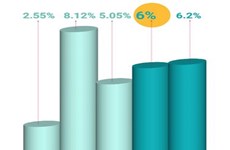

This year, the total expected pre-tax profits of 26 banks, which have announced their business plans this year, were estimated at 36.7 trillion VND (1.748 billion USD), rising 5.18 percent over last year.

The Vietnam Joint Stock Bank for Industry and Trade (VietinBank) led in terms of pre-tax profit plan in 2014 with 7.28 trillion VND (346.66 million USD), followed by Bank for Investment and Development of Vietnam (BIDV) with 6 trillion VND (285.7 million USD).

At the shareholders meeting held last week, Viecombank chairman Nguyen Hoa Binh noted that his bank expected to gain a pre-tax profit of 5.5 trillion VND (261.9 million USD), besides setting aside 5 trillion VND (238 million USD) for risk provision.

Vietcombank also targeted its total assets to rise by 11 percent against last year to 520.6 trillion VND (24.79 billion USD). The bank's lending and capital mobilisation are estimated to increase by 13 percent to reach 309.97 trillion VND (14.76 billion USD) and 384.49 trillion VND (18.3 billion USD), respectively.

Military Bank (MBB) and Sai Gon Thuong Tin Bank (Sacombank) also aimed to gain pre-tax profit of 3.1 trillion VND (147.619 million USD) and VND3 trillion ($142.8 million), respectively in 2014.

Another notable name this year is the Vietnam Prosperity Commercial JS Bank (VPBank) with a profit target of 1.89 trillion VND against last year's 1.35 trillion VND (64.5 million USD), surpassing many other listed banks, including SHB and ACB. VPBank's total assets are also targeted to reach 155 trillion VND (7.38 billion USD) against 121.26 trillion VND (5.8 billion USD) of last year.

According to Vietcombank's Binh, although the domestic economy is forecast to improve, many difficulties and challenges still lay ahead. Therefore, his bank will still adopt a cautious approach with regard to its performance plans this year. He further pointed out that it has planned to set aside 5 trillion VND (238.1 million USD) for risk provision against 3.5 trillion VND (166.66 million USD) of last year. However, he remarked that Vietcombank's move towards the market will be also flexible.

Meanwhile, VPBank General Director Nguyen Duc Vinh explained that the banking system this year will undergo continuous restructuring. Therefore, he stated that profits and size cannot be the top priority, but greater emphasis should be laid on risk management and business model streamlining to prepare for a leap in the post-restructuring period.

By the end of the first quarter of this year, several indications have hinted at dismal improvements in the profits made by the banks. The unsatisfactory improvement has been attributed to the difficulties faced by the banks' biggest income source from credit activities amidst low credit growth.

Furthermore, due to the impact of the macroeconomic context, especially the real estate, this year, bad debts will continue to affect the profits of the banking sector, industry insiders have forecast.-VNA

This year, the total expected pre-tax profits of 26 banks, which have announced their business plans this year, were estimated at 36.7 trillion VND (1.748 billion USD), rising 5.18 percent over last year.

The Vietnam Joint Stock Bank for Industry and Trade (VietinBank) led in terms of pre-tax profit plan in 2014 with 7.28 trillion VND (346.66 million USD), followed by Bank for Investment and Development of Vietnam (BIDV) with 6 trillion VND (285.7 million USD).

At the shareholders meeting held last week, Viecombank chairman Nguyen Hoa Binh noted that his bank expected to gain a pre-tax profit of 5.5 trillion VND (261.9 million USD), besides setting aside 5 trillion VND (238 million USD) for risk provision.

Vietcombank also targeted its total assets to rise by 11 percent against last year to 520.6 trillion VND (24.79 billion USD). The bank's lending and capital mobilisation are estimated to increase by 13 percent to reach 309.97 trillion VND (14.76 billion USD) and 384.49 trillion VND (18.3 billion USD), respectively.

Military Bank (MBB) and Sai Gon Thuong Tin Bank (Sacombank) also aimed to gain pre-tax profit of 3.1 trillion VND (147.619 million USD) and VND3 trillion ($142.8 million), respectively in 2014.

Another notable name this year is the Vietnam Prosperity Commercial JS Bank (VPBank) with a profit target of 1.89 trillion VND against last year's 1.35 trillion VND (64.5 million USD), surpassing many other listed banks, including SHB and ACB. VPBank's total assets are also targeted to reach 155 trillion VND (7.38 billion USD) against 121.26 trillion VND (5.8 billion USD) of last year.

According to Vietcombank's Binh, although the domestic economy is forecast to improve, many difficulties and challenges still lay ahead. Therefore, his bank will still adopt a cautious approach with regard to its performance plans this year. He further pointed out that it has planned to set aside 5 trillion VND (238.1 million USD) for risk provision against 3.5 trillion VND (166.66 million USD) of last year. However, he remarked that Vietcombank's move towards the market will be also flexible.

Meanwhile, VPBank General Director Nguyen Duc Vinh explained that the banking system this year will undergo continuous restructuring. Therefore, he stated that profits and size cannot be the top priority, but greater emphasis should be laid on risk management and business model streamlining to prepare for a leap in the post-restructuring period.

By the end of the first quarter of this year, several indications have hinted at dismal improvements in the profits made by the banks. The unsatisfactory improvement has been attributed to the difficulties faced by the banks' biggest income source from credit activities amidst low credit growth.

Furthermore, due to the impact of the macroeconomic context, especially the real estate, this year, bad debts will continue to affect the profits of the banking sector, industry insiders have forecast.-VNA