Banks rush to meet Basel II standards

If banks fail to increase their capital, credit growth will be narrowed. (Photo: Vietnamplus)

If banks fail to increase their capital, credit growth will be narrowed. (Photo: Vietnamplus)

Therefore, even banks that have successfully raised capital still have to continue to seek capital from strategic investors, as banks with small capital may face the risk of liquidity loss. In addition, the credit limit assigned by the management agency to banks is determined on their own capital, the higher the equity capital, the wider the credit "room" will be.

Safety – condition for growth

As the State has not supplemented charter capital for many years, the growth rate of charter capital is always lower than the growth rate of total assets, causing the capital adequacy ratio of the Big 4 group to decrease, much lower than the average level of domestic credit institutions, especially that of the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank) and the Bank for Agriculture and Rural Development of Vietnam (Agribank).

Although at the ninth session, the 14th National Assembly agreed to add a maximum of 3.5 trillion dong of charter capital to Agribank and the total charter capital of this bank is currently at 35,000 billion dong, the bank’s CAR was only 8.6 percent in 2019 after distributing profits according to the plan approved by the State Bank of Vietnam. The ratio was only 6 percent if calculated following Circular 41, much lower than the minimum regulated level of 9 percent. Therefore, despite capital increase, Agribank still did not reach the minimum capital adequacy ratio, and had to narrow its credit in 2021.

A transaction at Vietinbank (Photo: Vietnamplus)

A transaction at Vietinbank (Photo: Vietnamplus)To meet the demand for growth and maintain market share, playing a key role in banking activities, Chairman of the Board of Member of Agribank Pham Duc Anh proposed the Government, the Prime Minister, the State Bank of Vietnam and the Finance Ministry to consider increasing charter capital for Agribank and other State-owned joint stock commercial banks to ensure capital adequacy ratio. This increase in charter capital needs to be developed into a project for at least five years and approved by the Prime Minister to avoid being passive.

Ensuring the role of "midwife" for the economy

Currently, there are over 20 commercial banks implementing Basel II, of which 12 announced the completion of all three Basel II pillars ahead of time. Some banks have started to apply advanced standards and are preparing for Basel III.

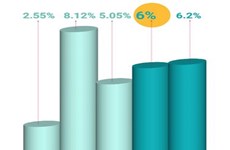

However, there are still many banks that have not yet met this standard, especially the state-owned joint stock commercial banks. This group of banks has a capital adequacy ratio of only 8-9%, which is more difficult than the private joint stock commercial banks, which are above 10%. This has put a lot of pressure on raising capital for four state-owned joint stock commercial banks - currently providing nearly 50% of the total outstanding loans of the whole system.

According to Chairman of VietinBank Le Duc Tho, capital adequacy regulations under Basel II force banks to have sufficient financial capacity to reserve for credit risks in the future. Credit limit is determined on own capital, so if capital cannot be increased, the chance for loan supply will be closed.

Agribank Chairman Pham Duc An also said that with the current CAR ratio, Agribank cannot increase credit, in contrast, must reduce it. According to Associate Professor, Dr. Do Hoai Linh - Institute of Banking and Finance, National Economics University, when the CAR of banks is lower than the regulations of Basel II, banks will have to limit, even stop providing credit. This will greatly affect the investment capital demand for Vietnam's socio-economic development, especially when currently 97% of small and medium-sized enterprises find it difficult to raise capital through issuance of stocks or bonds, so the development of the business depends heavily on bank credit./.