The COVID-19 outbreak has seriously affected the global economy, including Vietnam. However, from another perspective, the pandemic could promote the digital transformation in the banking system, such as moving transactions from “offline to online”. This movement has taken a clearer and clearer shape..

A number of commercial banks have invested in developing banking services in accordance with this trend in order to ensure customers can transact without any problem.

CASHLESS PAYMENT SEES SUDDEN SPIKE

During the complicated developments of the pandemic, limited direct contact is a condition.

Minh Thanh often eats at restaurants purely for convenience because of her busy schedule. However, since the outbreak of the pandemic, she has been ordering food and drink through online shopping apps.

“I can use my phone for ordering and paying, so I rarely use cash,” Thanh said, adding that she can also pay her rent through e-banking applications to minimise the risk of infection from cash and direct contact.

Nguyen Van Hung from Tay Ho district in Hanoi is also an online shopaholic. He said that his family mainly uses cards for payment instead of cash.

“I find online shopping convenient. It doesn’t take much time, and has a lot of promotions, with some items being discounted by more than 30 percent,” he said.

Hung added that his family is determined not to use cash payments anymore.

According to a Visa Vietnam survey, around 77 percent of the Vietnamese consumers know about digital banking services and up to 31 percent use them.

Consumers like the convenience of being able to carry out transactions at any time without having to go to a bank, with the highest numbers of people using them to pay bills (72 percent) and transfer money to family and friends (67 percent).

According to Dang Tuyet Dung, country manager for Visa Vietnam and Laos, the study has shown that Vietnamese consumers are increasingly willing to trust new payment services provided by prestigious firms.

She said that besides the safety and security these payment methods provide, they are also preferred for the increased control and oversight over personal finance.

The survey also shows that more and more people are interested in new payment methods, with 83 percent saying they are aware of biometric systems such as fingerprint and retina scan, and voice and facial recognition. Meanwhile, 62 percent are aware of numberless cards, with 77 percent saying they will use them in the future.

Dung said that the COVID-19 pandemic has pushed the shift toward cashless payments for small spending.

Gen Z consumers show remarkable trust and excitement in new payment services and consumption channels like social commerce, she noted.

They are a driving force behind commerce via social networks, with 85 percent knowing about it, and 68 percent using social media to view at least three reviews of products before making a first-time purchase, Dung said.

According to statistics from the State Bank of Vietnam (SBV), as of September 2021, the total number of transactions through the interbank electronic payment system increased by 1.88 percent in volume and 42.58 percent in value.

Payment activities through electronic channels have recorded strong growth, with those via mobile devices and the internet showing yearly increases of 50-80 percent, and 35-40 percent in volume, respectively.

Notably, many new and modern payment services such as bank cards, QR Code, and e-wallets have been deployed by banks and payment intermediary service providers.

EFFORTS TO BETTER CUSTOMER-SERVICE

The digital transformation is taking place rapidly with mobile banking applications, the use of automatic banking systems, and the provision of multi-platform online payment solutions for businesses.

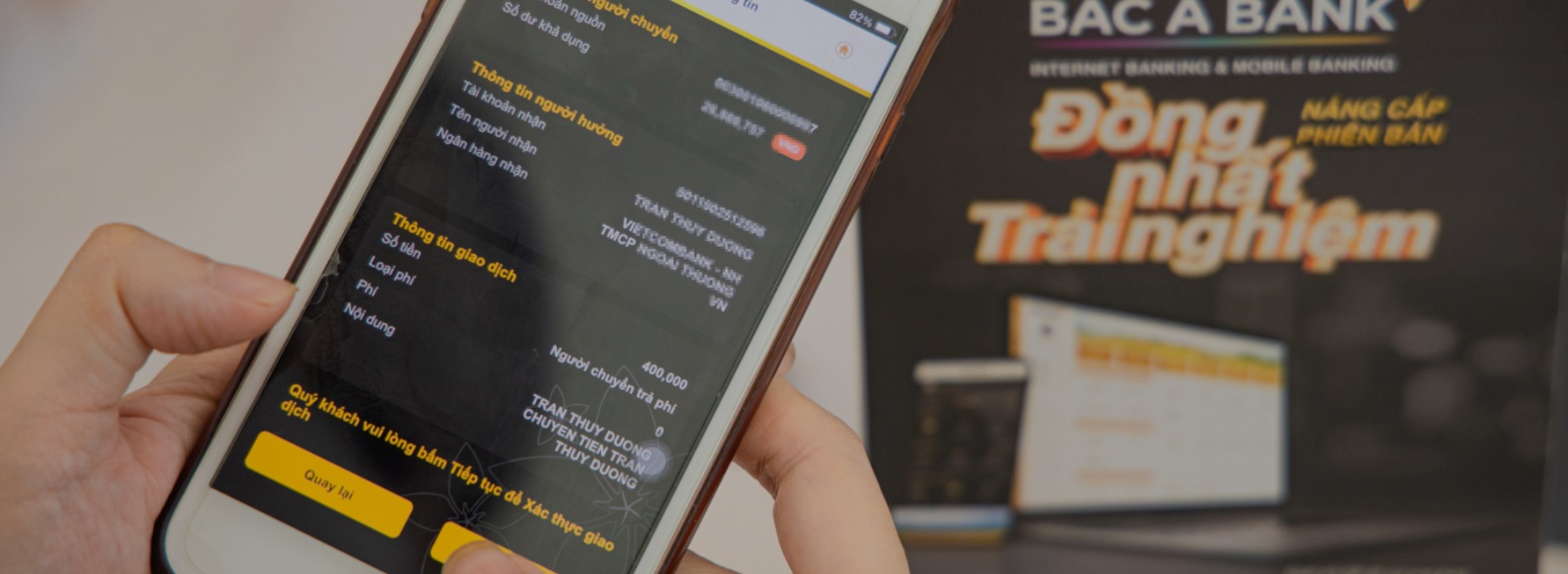

Bac A Commercial Joint Stock Bank (BAC A BANK) has also updated product and service features to provide more smooth and convenient transactions for customers.

This is not a random “step” by BAC A BANK due to COVID-19; but a long-term strategy.

According to leading officials of the bank, the plan to develop digital banking is part of its development strategy to 2030.

BAC A BANK has launched projects to upgrade e-banking services, towards realising its goal of diversifying and optimising customer experience.

In the third quarter of 2021, the bank launched an upgraded version of both Internet Banking and Mobile Banking services for individual customers.

These provide a seamless scientific experience for customers on electronic devices.

Users can also change their avatar and wallpaper, choose their favourite utilities for quick access, and set up a homepage to suit their needs.

Besides the smart interface, BAC A BANK’s e-banking application is also integrated with a series of features to help customers perform multiple transactions from paying electricity, water, television, and internet bills to charity money transfer, money transfer via identity documents, data recharge, and QR Pay payment. Every transaction is secured with the modern authentication method – Smart OTP.

The new version allows customers of BAC A BANK to log in with their own phone numbers registered for e-banking service, or with their fingerprints or facial recognition.

CUSTOMERS MAGAGE FINANCES

The bank balance feature will be integrated and displayed on BAC A BANK Mobile Banking.

Querying account information from the homepage, encrypting beneficiary accounts with QR code or querying transaction history are minimised with a few “touches”.

With this upgrade, the new version of BAC A BANK Mobile Banking is also simple and fast. Customers only need to update the application on Google Play or Apple Store, log in and activate Smart OTP by following the instructions to then fully experience new features and utilities – meeting most of their personal financial management and transaction needs.

“With these changes, we hope to meet and satisfy customers using BAC A BANK’s online banking channels, especially in the period of social distancing,” a bank representative said.

Thanks to the upgrade, customers can easily manage their finances through intuitive graphs and detailed information for each account.

CONVENIENT TRANSACTIONS

Increasing transactions via e-commerce platforms has brought benefits to consumers, especially during the COVID-19 pandemic.

BAC A BANK is also applying preferential fees for its customers such as free registration, free service maintenance, and free and reduced interbank money transfers.

The bank also applies a relatively higher transaction limit compared to those provided by other banks.

Specifically, with internal transfers, the limit is up to 1.5 billion VND (over 65,500 USD) per day and 800 million VND, while the inter-bank transfer limit is up to 1.5 billion VND per day and 500 million VND.

In addition to the fixed limits for all, BAC A BANK also offers higher limits for prioritised customers or those with special demand in accordance with its regulations.

“BAC A BANK’s app has helped me optimise financial transaction times with simple and fast procedures,” said Tran Ngoc Lan, a long-time customer of the bank.

“In the past, I still used to pay with cash, but recently I have switched to online shopping, and paying online,” she said.

Lan said with her phone, she can easily check account information and transfer money safely.

Meanwhile, Tran Thuy Duong from Hanoi’s Hai Ba Trung district said she has used BAC A BANK services for decades and found it very convenient.

Duong added that because she often shops online, she can directly share payment receipts via Facebook, Chat, Viber, and Zalo to sellers without needing to take a photo of invoices before sending them.

“BAC A BANK’s transfer service is free so I don’t mind transacting multiple times with small payments,” Duong said.

According to statistics from BAC A BANK, in the first seven months of 2021, the number of transactions increased by 200 percent over the same period in 2020.

Along with the popularity of digital transaction channels, many forms of fraud to hack electronic banking accounts have also become more sophisticated.

However, the bank is always updating its systems with the latest technologies to give customers’ peace of mind.

BAC A BANK also regularly updates, warns and provides information related to forms of fraud and bank account hacking to its customers via email, SMS and mass media.

Cashless payment is growing rapidly and this offers more opportunities for banks to develop their digital channels./.

Cashless payment is growing rapidly and this offers more opportunities for banks to develop their digital channels.