Credit growth reaches 11 percent

The banking sector’s credit growth reached 11 percent in 2013, which is

said to suit the banks’ “health,” the Lao Dong (Labour) newspaper

reported, citing reports of the State Bank of Vietnam (SBV).

The banking sector’s credit growth reached 11 percent in 2013, which is

said to suit the banks’ “health,” the Lao Dong (Labour) newspaper

reported, citing reports of the State Bank of Vietnam (SBV).

The loan to deposit ratio was between 91-92 percent, lower than the 2011 level (more than 100 percent).

Nguyen Thi Hong, head of the SBV’s Monetary Policy Department, said at the bank’s December 16 conference that the credit structure saw remarkable improvements, focusing on production and business, especially the prioritised fields.

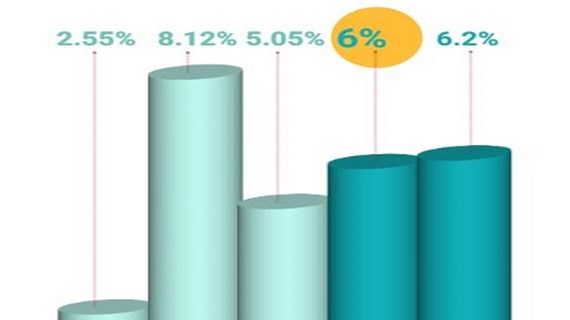

In the first 11 months of this year, credit to rural farm production increased by 17 percent; high technology - driven enterprises, 24.51 percent; and exports, 3.32 percent.

Bad debts were also gradually brought under control.

According to the SBV’s estimation, about 105.9 trillion VND (4.977 billion USD) of bad debt was settled during 2012 and the first 10 months of this year.

The bank said the interest rate in 2013 was kept stable, increasing only 1 percent against the forecast rate of 1-3 percent at the beginning of the year.

The year 2014 is forecast to still be difficult for the banking sector. Thus, the sector needs to prepare provision for bad debts. Nevertheless, the SBV projects that Vietnam ’s banking sector would grow by 12-14 percent in 2014. -VNA

The loan to deposit ratio was between 91-92 percent, lower than the 2011 level (more than 100 percent).

Nguyen Thi Hong, head of the SBV’s Monetary Policy Department, said at the bank’s December 16 conference that the credit structure saw remarkable improvements, focusing on production and business, especially the prioritised fields.

In the first 11 months of this year, credit to rural farm production increased by 17 percent; high technology - driven enterprises, 24.51 percent; and exports, 3.32 percent.

Bad debts were also gradually brought under control.

According to the SBV’s estimation, about 105.9 trillion VND (4.977 billion USD) of bad debt was settled during 2012 and the first 10 months of this year.

The bank said the interest rate in 2013 was kept stable, increasing only 1 percent against the forecast rate of 1-3 percent at the beginning of the year.

The year 2014 is forecast to still be difficult for the banking sector. Thus, the sector needs to prepare provision for bad debts. Nevertheless, the SBV projects that Vietnam ’s banking sector would grow by 12-14 percent in 2014. -VNA