Hanoi property market sees lower Q2 sales

Apartment sales in Hanoi declined in the second quarter, while their supply increased in the first half of the year, a new report says.

Apartment sales in Hanoi declined in the second quarter (Photo: VNA)

Apartment sales in Hanoi declined in the second quarter (Photo: VNA)Hanoi (VNA) – Apartment sales in Hanoi declined in the second quarter, while their supply increased in the first half of the year, a new report says.

In the second quarter, the high-end segment was the only part of Hanoi condominium market that gained, going up 1 percent and 3 percent in primary and secondary markets, respectively.

The second quarter report by CBRE, a leading property management agency, said that 8,086 units were launched in 27 projects across the city, a year-on-year increase of 23 percent but a quarter-on-quarter reduction of 14 percent.

Most of the apartments offered in the second quarter were those made by large projects after their first offerings failed to generate sufficient sales.

As in previous quarters, projects in the West and Southwest of Hanoi still dominated new launches, accounting for 68 percent of new stock, CBRE said.

The mid-end segment led new stock launches at 55 percent.

However, the market saw a 24 percent quarter-on-quarter reduction in the number of sold apartments at 4,650 units. This number is expected to recover next quarter when some attractive projects go online by the year end, the report said.

The Vietnam Real Estate Association said total value of property inventory in Hanoi as of June 20, 2017, was about 5429 trillion VND, a reduction of 161 billion VND compared to the end of 2016.

The structure of the property products experienced reasonable adjustments, the report said.

Most condominiums, including high-end units, had small and medium-sized apartments of 50-60sq.m per unit, so the selling price of each was not too high, suiting buyers’ capacities.

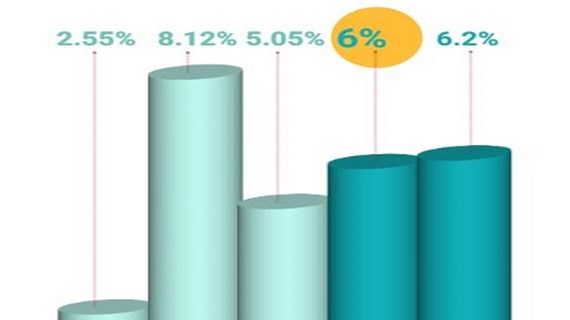

The CBRE Hanoi report also said that there was not much change in average prices between the first and second quarters in both primary and secondary markets.

Meanwhile, JLL, another foreign property consulting company in Vietnam, said in its quarterly report that on the primary market, prices declined in all segments, down 3.2 percent quarter-on-quarter.

In fact, there was a significant price decrease in luxury apartments after increasing for consecutive quarters, it said. But it was the “affordable” or lower end apartments segment that witnessed the lowest drop in the second quarter of 2017, JLL said.

On the secondary market, prices decreased at a higher rate than the primary market. In several projects, prices declined significantly because of the downgrade of properties, it said, without elaborating.

The JLL report also said more than 20,000 new units were expected to be completed by the end of the year, mostly in the mid-end segment.

In the 2018-2019 period, approximately 30,000 units are scheduled to enter the market each year.

Sales are expected to increase in the coming quarters, especially in the affordable and mid-end segments, according to the JLL report. Prices are likely to be stable in the coming time.

CBRE Hanoi said that in the second half of 2017, in addition to the supply coming from the West and Southwest areas of the capital city, there are plans to open new sales projects in the central districts.

By segment, the market is still waiting for affordable projects developed by reputable developers. In addition to affordable prices, the developers plan to offer better quality, apartment structure and conveniences for residents, it said.

Vietnam’s property market has developed strongly over the last 20 years, contributing greatly to national socio-economic development. But there are still limitations and challenges facing the sector.

At a property market review seminar held recently in Hanoi, the Construction Ministry’s Housing and Real Estate Market Management Department also said long-term solutions were needed to ensure sustainable development of the market in the future.

Based on several years of research on the property market, the ministry is preparing a plan that forecasts future trends.

This will be used by the Government to adopt policies and measures to regulate and manage the market with the aim of promoting stable and healthy development. The plan would also identify factors affecting Vietnam’s real estate market in the 2017-2020 period and beyond, the department said.

It notes that the Hanoi and HCM City markets experienced growth in different segments during the 2010- 2016 period.

Hanoi had a large absorption in segments of office for lease and commercial spaces, while supply was higher in these segments.

Meanwhile, growth in tourist arrivals boosted the hotel segment. Overall, there was no redundancy.

The plan envisages greater development of the secondary market in large cities over next five years, with average housing prices remaining stable for segments with large absorption.

The resort segment is set to attract more investment in the coming years, the seminar heard.-VNA