Market cap grows 62.7 percent on average over last three years

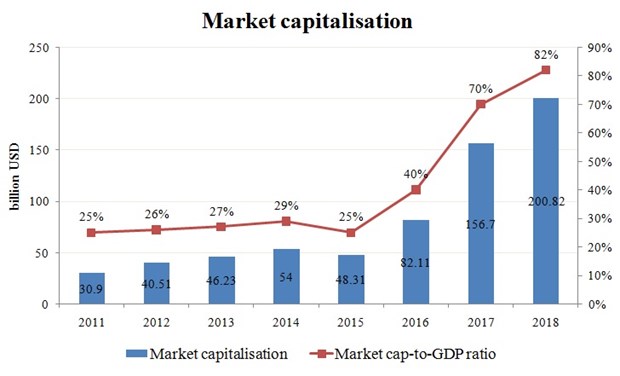

The market capitalisation has grown rapidly since 2016, by nearly 70 percent in 2016, 90 percent in 2017 and 28 percent in 2018, about 62.7 percent each year on average during the 2016 – 2018 period.

The market capitalisation has risen rapidly since 2016, by about 62.7 percent annually (Photo: VietnamPlus)

The market capitalisation has risen rapidly since 2016, by about 62.7 percent annually (Photo: VietnamPlus)Hanoi (VNA) – The market capitalisation has grown rapidly since 2016, by nearly 70 percent in 2016, 90 percent in 2017 and 28 percent in 2018, about 62.7 percent each year on average during the 2016 – 2018 period, according to the Central Institute for Economic Management (CIEM).

A recent CIEM report showed that the market capitalisation accounted for 26 percent of the gross domestic product (GDP) between 2011 and 2015. It continued to increase in the following years to reach 40 percent of the GDP in 2016, 70 percent in 2017 and 82 percent in 2018.

[Vietnamese stock market attracts foreign investment]

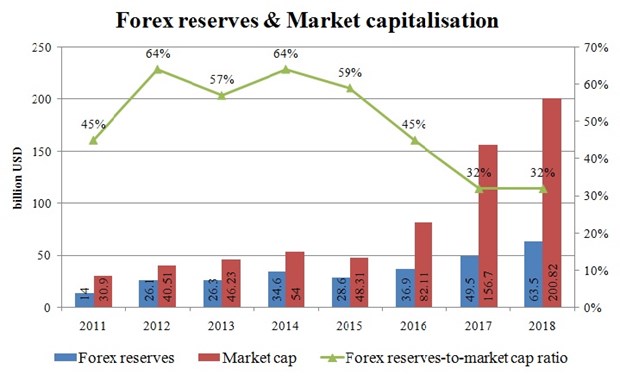

However, the report also pointed out that due to the rapid growth in market capitalisation, the percentage of foreign exchange reserves has decreased considerably, from the highest level of 64 percent in 2012 and 2014 to 32 percent in 2017 and 2018.

“This could increase the stock market’s vulnerability to divestment risks, especially capital divestment and transfer by foreign investors,” the CIEM warned.

In the Government’s economic restructuring plan, the restructuring of the financial system, including credit organisations, is always in focus, and the top priority is dealing with poor-performing commercial banks and non-performing loans (NPLs).

However, risks of non-performing loans remain large as such loans still accounted for some 5.5 percent of the total outstanding loans in late 2018, according to the CIEM report.

It added the NPL settlement has become more substantive and drastic since 2015. While NPLs were equivalent to 17.21 percent of the total outstanding loans in September 2012, by the end of December 2018, 890.27 trillion VND of NPLs had been handled, equivalent to more than 65 percent of total NPLs in the economy.

The settlement of NPLs has yet to be over due to several obstacles caused by the market’s principles. In particular, the development of the debt trading market still face difficulties, there have not been consistent standards for debt evaluation to serve as a basis for debt purchasers and sellers, and the number of investors in the market remains modest.

Additionally, while the quality of investors in the debt trading market is still low, there is also a shortage of the secondary and derivatives markets for NPLs, the report said.

According to Chairman of the State Securities Commission (SSC) Tran Van Dung, Vietnam’s stock market has been evaluated as a bright spot in the region in terms of growth speed and foreign capital absorption for years.

He said the foreign indirect investment (FII) in Vietnam reached 1.28 billion USD in the first six months of 2019. Between 2016 and 2018, the FII sector continuously net purchased local stocks worth 1.98 billion USD per annum.

The Vietnamese stock market has also been added to the watch list for possible upgrade to Secondary Emerging Market by FTSE Russell, a leading global provider of financial services, Dung noted.

The country aims to make the size of its stock market equal to 100 percent and 120 percent of the GDP in 2020 and 2025, respectively. It also looks to develop its bond market to be equivalent to 47 percent and 55 percent of the GDP in those respective years.

Meanwhile, the number of listed companies next year is hoped to increase by at least 20 percent from 2017. The number of investors in the market should account for 3 percent of the population in 2020 and 5 percent in 2025.

SSC Vice Chairman Pham Hong Son said that in 2018, the stock market proved to be an effective capital mobilisation channel for both the Government and the private sector. The Vietnamese market was assessed as the most successful in Southeast Asia in terms of capital mobilisation.

More than 278 trillion VND was mobilised through the stock market last year, up 14 percent from 2017. It included 192 trillion VND worth of government bonds raised for the Government, and over 86 trillion VND for businesses.

This has helped companies expand their production and business activities and reduce their reliance on bank loans, he noted./.