Over 2 mln USD for development of Vietnam's banking sector

Hanoi (VNA) - The "Vietnam: Strengthening banking sector soundness and development" project is expected to help the State Bank of Vietnam to better anticipate and increase resilience to shocks, as well as improve supervision capacity in accordance with world standards.

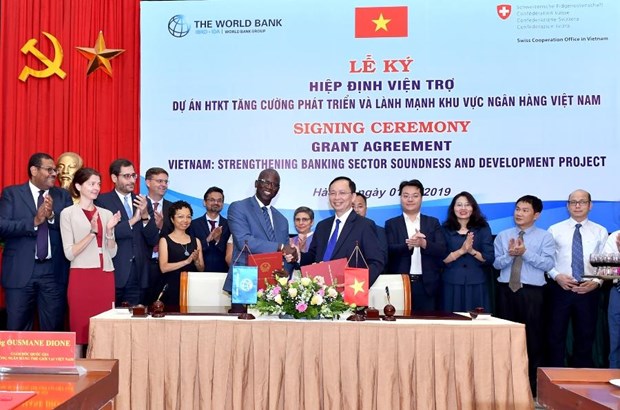

Ousmane Dione, Country Director of the World Bank, and Deputy Governor of the State Bank of Vietnam Dao Minh Tu at the signing ceremony. (Photo: VietnamPlus)

Ousmane Dione, Country Director of the World Bank, and Deputy Governor of the State Bank of Vietnam Dao Minh Tu at the signing ceremony. (Photo: VietnamPlus)

On October 1, in Hanoi, representatives of the World Bank and the State Bank of Vietnam signed an agreement for a grant worth 2.2 million USD provided by the Swiss Government to implement the "Vietnam: Strengthening banking sector soundness and development" project.

The project aims to enhance the soundness and resilience of the banking sector by improving the capacity of the State Bank of Vietnam in removing bottlenecks in the banking system’s structure.

Under the agreement, the WB will provide technical assistance to launch reforms set in the Restructuring Plan of the Financial System 2016-2020 and the Development Strategy of Vietnam Banking Sector to 2025.

Challenges facing the banking sector include issues related to asset quality, weak capitalization and regulatory constraints that hinder further investment in the sector. Moreover, Vietnamese banks have higher operating costs and have to make more plans providing for bad debts. The sector is reshuffling to make itself more market-oriented, based on international standards and stronger financial stability monitoring mechanisms.

Speaking at the signing ceremony, Ousmane Dione, Country Director of the World Bank in Vietnam, said that “A healthy banking sector, which is the largest segment of Vietnam’s financial system, is fundamental to the country’s sustainable economic growth”.

“By bringing in world-class expertise in banking sector development, we hope that we can support the State Bank of Vietnam in successfully implementing the structural reforms they are committed to deliver,” he added.

The World Bank will team up with the central bank of Vietnam to strengthen legal framework for the banking system, especially the Law on Credit Institutions and the National Assembly’s Resolution No. 42/2017/QH14 on tackling bad debts.

The project will also look to enhance the State Bank of Vietnam’s forecast and monitoring skills in line with global standards and practices, as well as develop bond market and raise the capacity of the Vietnam Asset Management Company.

The grant is part of the 8-million-USD project titled “Strengthening banking sector’s soundness and development” managed by Switzerland’s State Secretariat for Economic Affairs and the World Bank.

Talking about the policies and outlook of Vietnam’s banking system in 2019 and in the next few years, Jonathan Cornish, head of Asia-Pacific Financial Institutions at Fitch Ratings, said Vietnam’s strong economic growth is expected to be sustained in 2019-2020.

The banks have maintained their momentum in terms of profitability in 2019, aided in part by low credit costs and rapid growth in the higher-yielding retail loans, he said.

However, the latter could give rise to future asset quality problems in the event of a slowdown in the economy, he noted.

Over the past year, the State Bank of Vietnam has continued adopting flexible and harmonious monetary, fiscal, and macroeconomic policies to keep inflation under 4 percent again this year.

The bank has kept a close watch on the developments of the macroeconomy, as well as domestic and international financial and monetary markets; while monitoring monetary policy instruments in a proactive and prudent way to stabilise the currency and foreign exchange markets.

It has actively implemented measures to limit dollarisation in the country and increase public confidence in VND, thus contributing to stabilising the foreign currency and macroeconomic markets.

The central bank has directed credit institutions to increase the quality of credit packages, focusing on the Government’s priority business fields, and enabling businesses and locals to access credit capital.

It has also improved a legal framework to support bad debt settlement and the reshuffle of credit organisations./.