Piloting “mobile money”: Enterprises ready to join the race

Illustrative image (Photo: VietnamPlus)

Illustrative image (Photo: VietnamPlus)Hanoi (VNA) - Recently, the Prime Minister approved the pilot of a digital payment method called Mobile Money nationwide. The main services it provides include digital payment (transaction, bill payment), money transfer, small credit transaction, account management, and deposit and withdrawal at agents (of carriers). The State Bank of Vietnam has licensed the provision of payment intermediary services to three cellular providers, namely Viettel, VNPT and MobiFone.

Over the recent years, digital payment has become more and more popular, bringing benefits to users.

Currently, it is estimated that over 50 percent of the population have limited access to financial services, mostly in rural, remote, border and island areas. Therefore, the digital payment through mobile networks can be a useful tool to fully reach the areas.

The application of the mobile money digital payment services will help Vietnamese mobile users enjoy many benefits. It also comes in line with the policy of promoting non-cash payment by the government.

Ready for the bigger game

Statistics by the Department of Telecommunications show that by the end of 2020, Vietnam had 132.5 million active mobile subscribers, opening up opportunities for the mobile money services to reach these subscribers. Major Truong Quang Viet - Deputy General Director of Viettel Solutions Corporation - said that the operator has successfully tested Mobile Money for 40,000 internal employees, and is now ready to provide services to 100 percent of the Viettel customers in the coming time.

Mobile carriers are ready to join the 'new game'. (Photo: VietnamPlus)

Mobile carriers are ready to join the 'new game'. (Photo: VietnamPlus)"We have prepared information and knowledge to train Mobile Money points of sale. As soon as this project is approved, all of Viettel's agents will have a certain degree of knowledge and understanding regarding the use of the services. In addition, Viettel has also prepared a 24/7 customer care system to provide advice and answer all inquiries of customers," said Viet.

A representative of the VNPT said there are more than 10,000 transaction points owned by VNPT and partner enterprises and nearly 200,000 personal and household service agents in the country ready for the Mobile Money.

Bui Son Nam - Deputy General Director of MobiFone Telecommunications Corporation - said Mobifone had established the MobiFone Digital Service Center and prepared technical infrastructure to ensure the implementation of the Mobile Money.

The tens of thousands of transaction points of the MobiFone available across the country will help reduce costs to develop a new system of transaction points and expand non-cash payment services, the official said.

Tran Duy Hai - Deputy Director of the Department of Telecommunications - said that by taking advantage of the telecommunications network infrastructure and transaction points nationwide, telecommunications businesses have many advantages when deploying the Mobile Money.

Challenges arise in implementation

Hai also said that the implementation will also encounter certain difficulties as users or telecommunications businesses previously only provided e-wallets services. Now that the digital payment service is becoming more prevalent, many problems such as money laundering and protection may arise.

Telecommunication service providers will certainly face many challenges. Security, risk management and customer identification are among the issues which require special attention. The deputy director said the telecommunication enterprises which piloted the service must have an IT system that can provide Level 3 information system security as regulated by the current law. In addition, they must have a system to store the transaction history; as well as backup copy of the archived information to serve the inspection, examination and information provision upon request from the relevant state management agency.

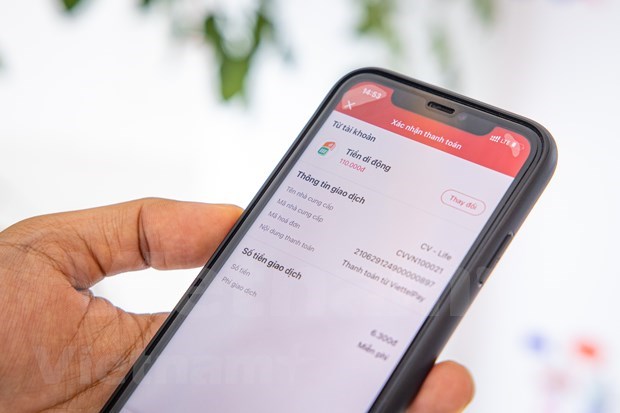

Illustrative image. (Photo: VietnamPlus)

Illustrative image. (Photo: VietnamPlus)As for the problem of Mobile Money service only allowing internal money transfer, Deputy Director Hai explained that Mobile Money accounts can only transfer money with those of the same service provider. The cross transaction between different providers is not yet available to reduce potential risks that may arise during the testing phase. After a period of implementation and evaluation can an inter-network operation be proposed. The Department of Telecommunications has also worked with providers and suggested that these units should develop extensive communications to customers, especially users in remote areas as they have rarely used or made non-cash payments.

From a business perspective, Major Viet said Viettel has experience in deploying e-wallets in six markets around the world. It will deploy the Mobile Money on the basis of the ViettelPay digital ecosystem. Viettel Pay has ensured that security related regulations meet the world's leading standards. Besides, Viettel also has a network security company that protects users from attacks on the system.

For anti-money laundering measures, Viettel applies big data technology and artificial intelligence to ensure the detection of all abnormal transactions. Moreover, the transaction limit of 10 million VND/month helps users experience the Mobile Money while minimising risks.

A representative of MobiFone said that this network operator has prepared technical, technological and policy conditions to ensure safety and security to avoid leaking of customer information. Specifically, the system must comply with the standards of the banking information technology system, transactions be encrypted and authenticated, and sensitive data of customers encrypted. The transaction history and account balance of the customers will be stored and information security policies implemented.

MobiFone also uses modern technologies such as AI and biometrics to automatically identify and authenticate customers. It will also compare customer identification information with MobiFone subscriber database to ensure accurate KYC information of customers./.