Provisional funds hit record high due to new regulations

Credit institutions had to provide nearly 4.13 billion USD of provisional funds by the end of June (Illustrative image. Source: cafef.vn)

Credit institutions had to provide nearly 4.13 billion USD of provisional funds by the end of June (Illustrative image. Source: cafef.vn)

Credit institutions had to provide nearly 89.7 trillion VND (4.13 billion USD) of provisional funds by the end of June, due to the application of new regulations earlier this year.

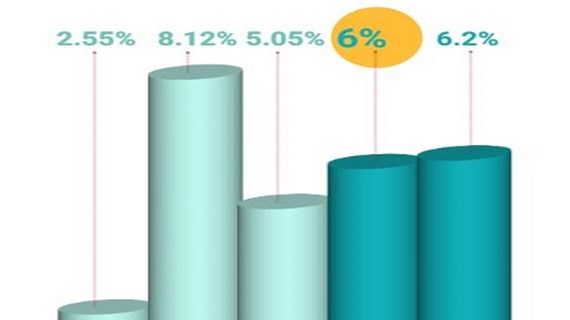

VnEconomy quoted a source from the State Bank of Vietnam as saying that the amount of provisional funds was the largest ever. The provisional funds of credit institutions in the 2012-14 period averaged roughly 70 trillion VND (3.22 billion USD). By the end of May 2012 and July 2014, the funds stood at 67 trillion VND (3.08 billion USD) and 78 trillion VND (3.59 billion USD), respectively.

The central bank said the increase in provisional funds was due to new regulations related to debt classification and risk provision, such as Circular 09 and Circular 02 that came into effect early this year. Under the new regulations, which are aimed to help the Government make an accurate and adequate appraisal of the lenders' non-performing loans (NPLs) to control bad debts better, more loans have become NPLs, and banks need more provisional funds to support the risk of the bad debts.

According to the central bank, by the end of September 2012, the lenders reported to the central bank a total of 133 trillion VND (6.12 billion USD) in NPLs, equal to 4.93 percent of the total outstanding loans. However, after cautious calculation, the central bank's figure was nearly 465 trillion VND (21.4 billion USD), or 17.21 percent of the total outstanding loans.

By the end of 2014, NPLs reduced to touch 214.9 trillion VND (9.9 billion USD), or 4.83 percent of the total outstanding loans, after the banking system handled 311 trillion VND (14.53 billion USD) of NPLs, or 67 percent of the total NPLs unveiled by the end of September 2012.

Large amounts of provisional funds for bad debts whittled away significant profits of credit institutions in H1, though their credit growth was high.

For example, Vietcombank Chairman Nghiem Xuan Thanh said the bank earned about 6.04 trillion VND (287.62 million USD) in profits during H1, an increase of 16.6 percent over the same period last year. However, the establishment of a provisional fund of nearly 2.30 trillion VND (109.52 million USD) resulted in the real H1 profit of only 3.04 trillion VND (144.76 million USD), which represented a year-on-year increase of 9.45 percent.

The central bank recently also urged credit institutions to speed up the sales of bad debts to the Vietnam Asset Management Company (VAMC), in a bid to reduce the overall NPL ratio in the domestic banking system to less than 3 percent by the end of September this year.-VNA