Shares flat on low volumes

Indices on both the nation’s stock exchanges closed in the red on May

12, with the combined market value of both bourses reaching only 785

billion VND (37 million USD).

Indices on both the nation’s stock exchanges closed in the red on May

12, with the combined market value of both bourses reaching only 785

billion VND (37 million USD).

“Banks have had to raise deposit interest rates to attract capital as dong deposits have fallen,” securities analyst Ho Ba Tinh wrote in a report on May 12. “This is an indication that interest rates are unlikely to fall in short term, and cash flows into the stock market will continue to be limited.”

The only bright spot, Tinh suggested, was the meagre market volumes suggested that shares have reached their lowest prices.

On HCM Stock Exchange, the VN-Index ended the session of 0.2 percent, closing at 482.14.

Decliners outnumbered advancers by about two-to-one and, of the 10 leading shares by capitalisation, only Eximbank (EIB) saw modest gains on the day. Sacombank (STB) was again the most-active share, with 1.2 million shares traded. The overall value of trades on May 12 eased to 530 billion VND (25 million USD), 6 billion VND (286,000 USD) lower than May 11’s value, although the volume of trades increased slightly to 22 million shares.

On the Hanoi Stock Exchange, the HNX-Index dropped by half a percent to close at 82.33 points. Decliners outnumbered advancers by 176-82.

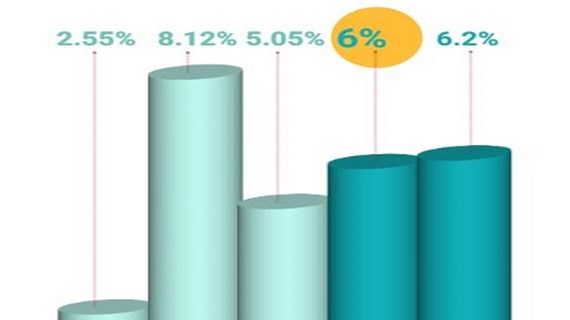

Market value reached 255 billion VND (12 million USD), 5 percent higher than the previous day, while volume jumped 8 percent to around 20 million shares.

Beverages producer Thai Hoa Group (THV) saw the highest activity, with 2.4 million shares changing hands.

Foreign investors were net sellers in HCM City on May 12 of a net 94 billion VND (4.5 million USD) worth of shares. In Hanoi , they returned to being net buy, picking up a net of 4.7 billion VND (224,000 USD) worth of shares, after being net sellers on May 11./.

“Banks have had to raise deposit interest rates to attract capital as dong deposits have fallen,” securities analyst Ho Ba Tinh wrote in a report on May 12. “This is an indication that interest rates are unlikely to fall in short term, and cash flows into the stock market will continue to be limited.”

The only bright spot, Tinh suggested, was the meagre market volumes suggested that shares have reached their lowest prices.

On HCM Stock Exchange, the VN-Index ended the session of 0.2 percent, closing at 482.14.

Decliners outnumbered advancers by about two-to-one and, of the 10 leading shares by capitalisation, only Eximbank (EIB) saw modest gains on the day. Sacombank (STB) was again the most-active share, with 1.2 million shares traded. The overall value of trades on May 12 eased to 530 billion VND (25 million USD), 6 billion VND (286,000 USD) lower than May 11’s value, although the volume of trades increased slightly to 22 million shares.

On the Hanoi Stock Exchange, the HNX-Index dropped by half a percent to close at 82.33 points. Decliners outnumbered advancers by 176-82.

Market value reached 255 billion VND (12 million USD), 5 percent higher than the previous day, while volume jumped 8 percent to around 20 million shares.

Beverages producer Thai Hoa Group (THV) saw the highest activity, with 2.4 million shares changing hands.

Foreign investors were net sellers in HCM City on May 12 of a net 94 billion VND (4.5 million USD) worth of shares. In Hanoi , they returned to being net buy, picking up a net of 4.7 billion VND (224,000 USD) worth of shares, after being net sellers on May 11./.