Sluggish blue-chips depress shares

The VN-Index failed to reach 515 points on June 24, retreating 0.22

percent to end the session at 511.67 points, led by sluggish trading in

blue-chips despite improved economic data.

The VN-Index failed to reach 515 points on June 24, retreating 0.22

percent to end the session at 511.67 points, led by sluggish trading in

blue-chips despite improved economic data.

Trade value on the HCM City Stock Exchange rose nearly 13 percent to 1.6 trillion VND (84.7 million USD), on a volume of 52.7 million shares. Gainers outnumbered losers by 109-90, with PetroVietnam Transportation (PVT) being the most active share on a volume of nearly 3 million shares traded.

Shares rose to nearly 515 points before turning back to slide under 512 points on stronger sales in the final minutes of the session. Most blue-chips lost value on low trading volume, evidenced by the fact that the 10 largest capitalised shares saw their trades fall under 1 million.

Increased trading volume was attributed to busy trades in small - and mid-cap shares, with many penny stocks continuing to rise, such as Do Thanh Technology (DTT), South Vietnam Container Shipping (VSG), Vien Dong Investment Development Trading (VID) and PetroVietnam General Services (PET).

By contrast, the HNX-Index on the Hanoi Stock Exchange edged a tiny gain of 0.07 percent to close the day's trades at 162.98 points, led by a rise in Lilama-affiliated companies.

Market liquidity improved minimally, reaching 39.6 million shares worth a combined 1.26 trillion VND (66.7 million USD). Advancers outnumbered decliners by 158-90, with PetroVietnam Construction (PVX) still being the most heavily-traded share on the bourse on a volume of over 3 million.

Companies under the umbrella of the Lilama group, including LM3, L43, L35, L44, L61 and LIG, soared to the ceiling prices which are capped at 7 percent daily.

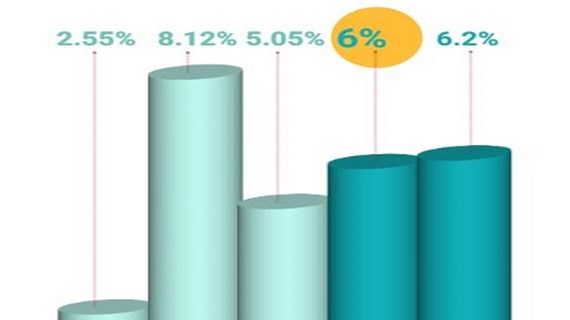

National inflation was reported to stay low at 0.22 percent in June, and second quarter GDP is expected to range from 6.2-6.4 percent, painting a rather bright economic outlook for the nation in the coming months.

"However, most investors anticipated this economic scenario, so such information will not affect market performance in the short term," said Bao Viet Securities Co's analyst Tran Thi Hai Yen.

Yen said the market would likely fluctuate in a tight range, showing the current value reflected investor expectations for economic performance.

Many analysts said the market would rise if it received signs of stable growth in global markets and solid profits among listed companies in the second quarter.

Foreign investors continued to be net buyers in the HCM City market, responsible for the purchase of 1.5 million shares worth a combined total of more than 75 billion VND (4 million USD). By contrast, they were net sellers in the Hanoi market, for a total value of less than 1 billion VND (52,910 USD)./.

Trade value on the HCM City Stock Exchange rose nearly 13 percent to 1.6 trillion VND (84.7 million USD), on a volume of 52.7 million shares. Gainers outnumbered losers by 109-90, with PetroVietnam Transportation (PVT) being the most active share on a volume of nearly 3 million shares traded.

Shares rose to nearly 515 points before turning back to slide under 512 points on stronger sales in the final minutes of the session. Most blue-chips lost value on low trading volume, evidenced by the fact that the 10 largest capitalised shares saw their trades fall under 1 million.

Increased trading volume was attributed to busy trades in small - and mid-cap shares, with many penny stocks continuing to rise, such as Do Thanh Technology (DTT), South Vietnam Container Shipping (VSG), Vien Dong Investment Development Trading (VID) and PetroVietnam General Services (PET).

By contrast, the HNX-Index on the Hanoi Stock Exchange edged a tiny gain of 0.07 percent to close the day's trades at 162.98 points, led by a rise in Lilama-affiliated companies.

Market liquidity improved minimally, reaching 39.6 million shares worth a combined 1.26 trillion VND (66.7 million USD). Advancers outnumbered decliners by 158-90, with PetroVietnam Construction (PVX) still being the most heavily-traded share on the bourse on a volume of over 3 million.

Companies under the umbrella of the Lilama group, including LM3, L43, L35, L44, L61 and LIG, soared to the ceiling prices which are capped at 7 percent daily.

National inflation was reported to stay low at 0.22 percent in June, and second quarter GDP is expected to range from 6.2-6.4 percent, painting a rather bright economic outlook for the nation in the coming months.

"However, most investors anticipated this economic scenario, so such information will not affect market performance in the short term," said Bao Viet Securities Co's analyst Tran Thi Hai Yen.

Yen said the market would likely fluctuate in a tight range, showing the current value reflected investor expectations for economic performance.

Many analysts said the market would rise if it received signs of stable growth in global markets and solid profits among listed companies in the second quarter.

Foreign investors continued to be net buyers in the HCM City market, responsible for the purchase of 1.5 million shares worth a combined total of more than 75 billion VND (4 million USD). By contrast, they were net sellers in the Hanoi market, for a total value of less than 1 billion VND (52,910 USD)./.