Some non-resident digital traders, service providers yet to fulfil tax obligations in Vietnam

There are still non-resident traders and service providers who are yet to register, file and pay taxes for doing business on digital platforms in Vietnam, according to the General Department of Taxation (GDT)’s Large Taxpayers Department.

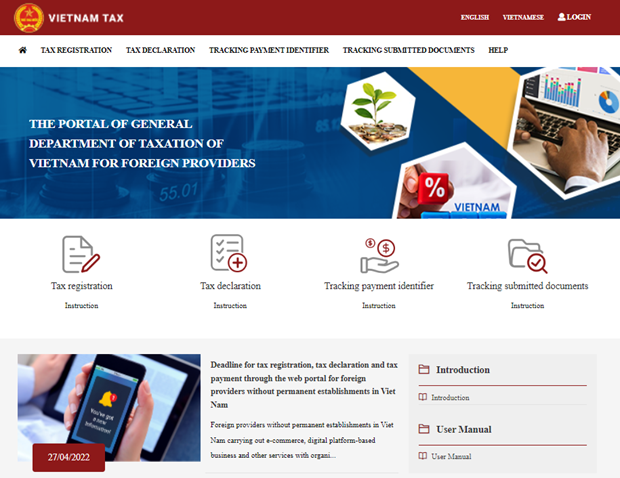

Vietnam's electronic tax service portal designated for non-resident digital traders and service providers. (Photo: VNA)

Vietnam's electronic tax service portal designated for non-resident digital traders and service providers. (Photo: VNA)The statement was made after the GDT sent a notice to remind them of the deadline for tax registration, filing and payment on April 28.

The department said it issued tax codes for a number of the non-resident digital businesses who had then fulfilled tax obligations via an electronic portal (https://etaxvn.gdt.gov.vn) designated for them, while some failed to do the same.

The due date for completing tax registration, filing and payment for the first quarter of this year is April 30, the department noted.

Those missing the deadline will have their names publicised on the GDT’s official website and media outlets.

Under Vietnam’s regulations, non-resident trade and service providers operating on digital platforms are obliged to directly register, file and pay taxes in Vietnam. They can also authorise an agent to do so on their behalf./.