Standard Chartered forecasts Vietnam’s 2022 growth rate at 6.7 percent

Illustrative image (Source: VNA)

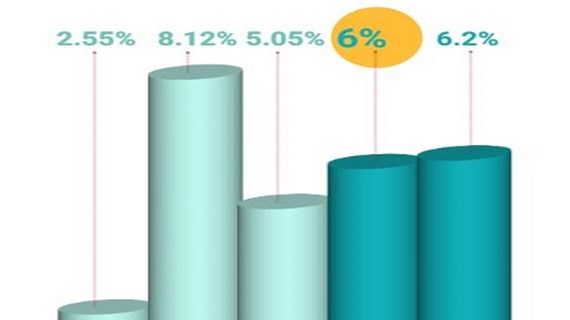

Illustrative image (Source: VNA)Hanoi (VNA) - Vietnam's economy is predicted to bounce back strongly, growing at 6.7 percent this year and 7.0 percent in 2023, according to Standard Chartered Bank.

In the bank’s report released on January 12, Tim Leelahaphan, economist for Thailand and Vietnam at Standard Chartered, said the economy looks likely to continue bouncing back in 2022 as the pandemic improves.

Income growth has outpaced spending growth in recent years, providing a decent savings buffer against the pandemic.

“COVID-19 remains a key risk, at least in the short term. The first quarter could see a full resumption of factory operations, after closures in Q3/2021, and government stimulus; clearer recovery is expected in March,” he noted.

Economists at Standard Chartered said a continued improvement in the global trade environment will support exports in 2022, although import growth is likely to remain high.

Inflation may become more of a concern for Vietnam in 2022. Supply-side factors – including higher commodity prices, exacerbated by the pandemic – are likely to be a key driver near-term; and demand pressures will come into play as the economy develops further.

A prolonged virus outbreak could lead to supply-driven inflation risks. In the next two years, inflation forecasts for Vietnam are 4.2 percent and 5.5 percent respectively.

According to the Standard Chartered Bank, the State Bank of Vietnam (SBV) is expected to keep its policy rate on hold at 4 percent in 2022 to support credit growth, manage inflation risks and normalise the policy in 2023, with a hike of 50 basis points to 4.5 percent in Q4 of 2023.

Standard Chartered Bank maintains its medium-term constructive view on the VND amid expectations of a strong balance of payments. The rapid pace of appreciation since July reflects more flexible exchange rate management by the central bank.

The VND was among the best-performing emerging market currencies in 2021. However, the bank expects the pace of appreciation to slow down given that Vietnam’s current account is now in deficit, and the USD-VND exchange is approaching the limits of the rate band.

Vietnam’s surplus in the balance of payments and the central bank’s foreign exchange policy flexibility should continue to support the VND over the medium term. The bank forecasts a USD-VND rate at 22,500 by mid-2022 and at 22,300 by the end of 2022.

Ben Hung, CEO for Asia at Standard Chartered Bank, added: "The future of sustainability and our journey towards net-zero requires joint efforts and collective action.

"Vietnam is an important market in Standard Chartered’s Asia footprint and we are committed to investing in the country, to help finance its sustainable development and secure greater economic prosperity.

“We will continue to connect Vietnam with the world and provide sustainable finance to areas where it matters most. We believe that the Government’s enhanced focus on greening the economy will offer businesses and investors increased confidence to invest more into Vietnam’s sustainability agenda for the long term.”

Michele Wee, CEO at Standard Chartered Bank Vietnam, commented: “The Vietnamese economy is now on a recovery trajectory. In our market research, our clients have told us that Vietnam holds tremendous potential for growth and investment attraction.

"The country is playing an increasingly important role in international trade and the global supply chain. As a leading international bank in Vietnam, we remain fully committed to supporting the country’s strong, sustainable recovery and growth in 2022, and the years to come.”

Can Van Luc, chief economist with the Bank for Investment and Development of Vietnam (BIDV), on January 12 predicted Vietnam’s GDP growth rate at 6.5-7 percent in 2022, and CPI growth at 3.4-3.7 percent.

Luc and his colleagues also forecast that the country’s export-import value would reach 752 billion USD in the year.

They said limitations in the COVID-19 fight, pandemic impacts on economic sectors, slow recovery of services, and low social investment remain risks and challenges to national growth./.