Strong growth potential to support stabilisation in VN’s debt burden: Moody’s

Strong economic growth will likely continue in Vietnam over the next few years and support a stabilisation in debt, Moody's Investors Service said on August 21.

Workers produce electronic components at the Japanese-invested Canon factory in the Pho Noi A Industrial Park, Hung Yen province (Photo: VNA)

Workers produce electronic components at the Japanese-invested Canon factory in the Pho Noi A Industrial Park, Hung Yen province (Photo: VNA)Hanoi (VNA) – Strong economic growth will likely continue in Vietnam over the next few years and support a stabilisation in debt, Moody's Investors Service said on August 21.

It said the growth will be supported by the economy's rising competitiveness, healthy trade flows and robust consumption, but banking system risks and a history of susceptibility to destabilising financial market cycles remain a constraint on broader economic strength.

Moody's conclusions are contained in its just-released report "Government of Vietnam: FAQ on prospects for growth, trade and government debt".

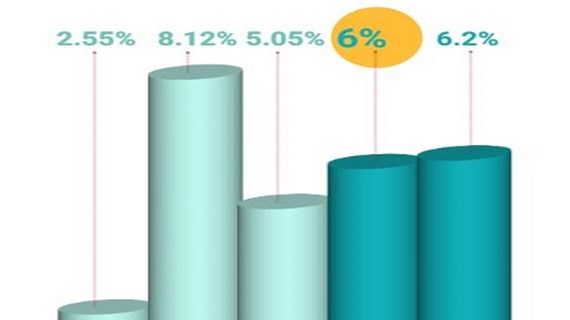

The report says that investment is largely responsible for the 6-percent growth recorded over the last decade for the Vietnamese economy, but productivity will increasingly drive headline growth as the economy moves up the value-chain and the role of the private sector increases.

These competitiveness improvements, together with a mix of healthy trade flows and robust consumption, will support average GDP growth of 6.4 percent between 2018-2022, which is nearly double the 3.5-percent median for Ba3-rated sovereigns like Vietnam.

Meanwhile, the effects of the ongoing trade dispute between the US (Aaa stable) and China (A1 stable) may be detrimental for Vietnam if tariffs are extended to products within the mobile phone supply chain - that Vietnam specializes in - or affected other economies with which it has strong trade ties, such as the Republic of Korea (Aa2 stable).

At 52 percent of GDP, the government debt is now largely in line with the median of about 50 percent for Ba-rated sovereigns. The rapid pace of nominal economic growth will stabilize debt at this level. Moreover, the structure of debt has improved, with lengthening maturities and a declining share of foreign-currency debt limiting Vietnam's vulnerability to financial shocks, Moody’s added.-VNA