USD/VND exchange rate surges as US-China trade war drags on

Hanoi (VNA) – The USD/VND exchange rate has grown strongly at the heart of the global fight over economic dominance between the US and China, the world’s two largest economies, banking and finance expert Nguyen Tri Hieu has said.

Trading of foreign currency at a commercial bank in Hanoi (Photo: VietnamPlus)

Trading of foreign currency at a commercial bank in Hanoi (Photo: VietnamPlus)

The State Bank of Vietnam (SBV) set the daily reference exchange rate at 23,100 VND per USD on August 5, up 10 VND from the end of last week and making the rate at commercial banks move up 30-50 VND per USD.

With the current trading band of +/- 3 percent, the ceiling rate applied to commercial banks on the day is 23,793 VND per USD, and the floor rate at 22,407 VND per USD.

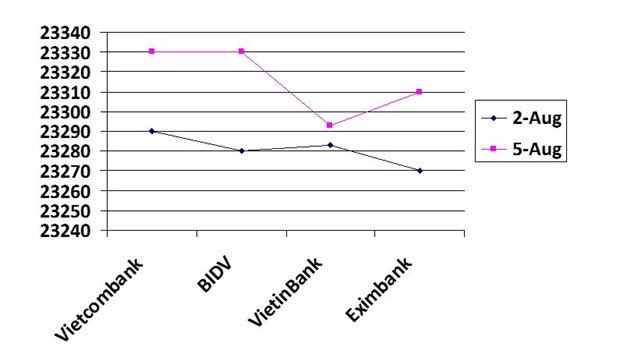

Vietcombank and the BIDV listed the buying rate at 23,210 VND per USD and the selling rate at 23,330 VND per USD, up 50 VND compared to the previous week.

Similarly, the rate at Vietinbank increased 46 VND, at 23,185 VND (buying) and 23,290 VND (selling).

In addition, the exchange rates at ACB, Eximbank and Techcombank experienced strong growth, up 50 VND, 40 VND and 30 VND from the end of last week.

The trend is currently contrary to the global market as USD is losing its value but appreciating against VND.

Hieu said that the exchange rate has been affected by the escalating trade tensions between the US and China as both sides have imposed rigid trade policies on each other.

To be more specific, US President Donald Trump already announced on August 1 that he would put a small additional tariff of 10 percent on the remaining 300 billion USD of products originating from China into the US from September 1, which, combined with previous tariffs, effectively taxes nearly all made-in-China goods.

Earlier, the US administration raised the tariff on 200 billion USD worth of Chinese imports to 25 percent.

Right after Trump’s tweet, Chinese Foreign Ministry’s Spokesperson Hua Chunying stated if Washington still accelerates its plan to apply new tariffs, Beijing will take necessary retaliatory measures to protect benefits of the country and people.

USD/VND exchange rates offered by some commercial banks on August 2 and August 5 (Photo: VietnamPlus)

Hieu said that Bejing kept its pledge for retaliation by depreciating its currency to counter President Donald Trump’s latest tariff threat. The CNY plunged beyond 7 per USD for the first time since 2008 while the exchange rate normally hovered around 6.8-6.9 CNY per USD.

The CNY devaluation also resulted in a weaker VND, Hieu stressed, explaining Vietnam had to devalue its currency against USD to support exports and avoid cheaper Chinese goods to flood the local market.

“It is clear that fluctuation of USD/VND exchange rate moves in tandem with that of CNY/USD,” he said.

Any currency fluctuation can affect local economy. First, a weakened VND against USD will facilitate Vietnamese exports to the American market as products will be sold at lower prices. Meanwhile, it poses challenges to imports as local firms have to pay more for the imported goods, and this could affect the macro-economy, particularly inflation and public debts.

“This is also unusual as the VND/USD exchange rate would remain stable or decrease when the US Federal Reserve decided to cut interest rate by 0.25 percent; however, it shoots up today so I think the VND correlate with the CNY more than the USD,” Hieu analysed.

In the context that the US-China trade war continues to become more complicated, and the exchange rate may increase further, the SBV should be more flexible in its policies while maintaining the central exchange rate policy and abundant amount of foreign currency reserve so as to stabilise the foreign exchange rate, he recommended./.