What is personnel structure of Vietnam Stock Exchange

Illustrative image (Photo: VietnamPlus)

Illustrative image (Photo: VietnamPlus)

Hanoi (VNA) – The Vietnam Stock Exchange has no plans to hire new employees, but will transfer employees from member exchanges to the parent exchange, with human resources at member exchanges focusing on operating the trading floor.

Prime Minister Nguyen Xuan Phuc approved a scheme on the establishment of the Vietnam Stock Exchange on January 7.

The move surprised many traders and attracted great attention, even though at the review conference 2018 of the State Securities Commission, Deputy Minister of Finance Huynh Quang Hai highlighted several tasks of the sector in 2019, including merging the Hanoi Stock Exchange (HNX) and the Ho Chi Minh Stock Exchange (HOSE).

Ta Thanh Binh, Director of the Securities Market Development Department of the State Securities Commission, shared more about this issue with reporters.

The Government’s approval of the project establishing the Vietnam Stock Exchange according to the model of parent-subsidiary company based on the rearrangement of the HNX and HOSE surprised the public. Could you tell more about this model?

Ta Thanh Binh: Many people were surprised and not convinced about the establishment of the Vietnam Stock Exchange in the parent-subsidiary model.

However, the Prime Minister has only ratified the project and is yet to issue a decision to set up the Vietnam Stock Exchange. According to the project, the Vietnam Stock Exchange will be formed based on HNX and HOSE. They are still the two legal entities and can be called subsidiaries of the Vietnam Stock Exchange.

The establishment of the Vietnam Stock Exchange aims to address shortcomings of the two current independent exchanges. Specifically, the current model creates unclear market distinctions about goods and trading systems on HNX and HOSE floors.

The independence and differences between the two stock exchanges are causing a waste of social resources as well as costs of members in the system and investors. Additionally, the two exchanges have the same sections or departments in terms of administration, development research and international cooperation.

Across the world, the trend in many countries is to merge local exchanges to increase their competitiveness at the international level.

In Vietnam, the establishment of the Vietnam Stock Exchange has seen capital transferred from Hanoi Stock Exchange and Ho Chi Minh Stock Exchange to create the best conditions for the development of the Vietnamese securities market.

The Vietnam Stock Exchange has the tasks of focusing on product development, serving as the coordinator for participation in international organisations to which the HNX and HOSE are members, and implementing the management and development of information technology systems.

Ta Thanh Binh, Director of the Securities Market Development Department of the State Securities Commission, talks to the press (Photo: VietnamPlus)

Ta Thanh Binh, Director of the Securities Market Development Department of the State Securities Commission, talks to the press (Photo: VietnamPlus)

Will the establishment of the parent-subsidiary model increase pressure on personnel? How is this model carried out elsewhere?

In terms of personnel, there will be no increase in the field, instead personnel will be transferred to the parent exchange from subsidiaries. Human resources in subsidiary exchanges will focus on operating the trading platform for goods identified according to the restructuring roadmap.

This model has been applied in developed markets in the region such as Japan. Previously, this country had the Tokyo Stock Exchange and Osaka Stock Exchange. In 2013, Japan merged the two exchanges to establish the Japanese Exchange Group (JPX) using the parent-subsidiary model. The two exchanges still independently manage their markets with separate products.

Additionally, the stock exchange models in the Republic of Korea and Singapore were also studied during the process of setting up the scheme.

Vietnam strives to become a startup country and build a stock exchange for startups to make it easier for them to mobilise capital. How will this be achieved?

It is necessary to have a stock market for startup businesses. However, startups are non-public, newly established and active in areas that hold a lot of risks. According to stock market principles, businesses that want to issue shares to the public or on the stock market must meet prescribed conditions. If applying the general standards of today’s market, it will be difficult for startups to issue and trade stocks and to be listed on the market.

Therefore, startups businesses need their own market with separate conditions and standards. Investors as well as participants in the market will also be absolutely different.

The State Securities Commission has studied neighbouring markets such as Thailand about the establishment of an online trading platform for startups using blockchain technology along with legal documents.

In the draft Law on Securities, the commission has left regulations open to allow the Government to guide the formation of a stock market for startup businesses in the future.

What do you think about the development trends of the Vietnamese stock market in 2019?

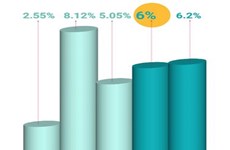

In 2018, the stock market saw great fluctuations mainly because of global factors. Amid major fluctuations in the international financial market, the maintenance of foreign capital flow in the market is considered a bright spot as foreign investors net purchased 2.8 billion USD, and the total value of their portfolios was estimated at 32.8 billion USD during 2018.

Observing trading sessions, foreign investors sold net but they did not withdraw money from their accounts, which showed their confidence in the market’s potential in the medium and long term.

In 2019, fluctuations on the global market will be very unpredictable while the openness of the economy is increasing. Therefore, negative impacts are inevitable. However, positive signs from the economy and the determination of the Government to maintain stable and sustainable growth will help the Vietnamese stock market increase its resilience against external factors. Market volatility will be short-term and there will be no deep decline in 2019.

In addition, the Securities Commission will implement many solutions to improve the quality and scale of the market as well as offer new products according to international practices in the derivatives market while increasing goods quality, and speeding up the promulgation of the revised Law on Securities to address existing problems. The commission will also strengthen inspections and upgrade the market to attract domestic and foreign investors. The stock market is expected to continue growing with new attractiveness this year.-VNA