Listed automobile companies will face a challenging and volatile year in 2017 on policy changes and rising competition from imported products (Photo: cafef.vn)

Listed automobile companies will face a challenging and volatile year in 2017 on policy changes and rising competition from imported products (Photo: cafef.vn) Hanoi (VNA) - Listed automobile companies will face a challenging and volatile year in 2017 on policy changes and rising competition from imported products.

As the sector outlook is unclear, some companies have been cautious with their forecast for 2017 performance. For instance, Saigon General Service Corporation performed well in 2016, but the company is quite wary of its results this year.

Challenges include policy changes expected to trigger greater competition in the domestic car market as taxes drop, allowing imported cars to compete with local products.

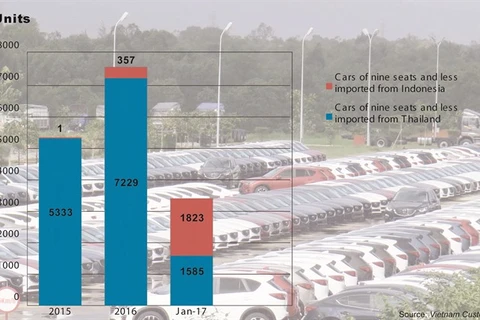

VietDragon Securities Corporation (VDSC) said in its 2017 outlook for the automobile industry that the domestic car market will see an increase of automobile imports from ASEAN countries as car import tariffs have dropped to 30 percent from 40 percent in 2016, and will eventually fall to zero early next year.

Meanwhile, Vietnamese automobile companies are waiting for the Government to decide in July whether car manufacturing and importing business should be conditional or not.

If the car industry becomes a conditional sector, domestic car companies would be protected by the Government, but they would be limited in access to foreign investment since a conditional business must follow some rules to ensure the country’s security and safety.

Foreign investors would be limited in investment in the Vietnamese car industry, reducing foreign capital in the industry, and some of the foreign-invested car firms could suffer.

Automobile companies had mixed performances in 2016, with Truong Long Auto and Technology JSC and TMT Motors Corporation being decliners and Hoang Huy Investment Services Corporation among the gainers.

Truong Long Auto and Technology JSC last year earned 1.2 trillion VND (53.3 million USD) and a net profit of 53 billion VND, a year-on-year drop of 28.6 percent and 39.25 percent from 2015.

TMT Motors Corporation earned 2.5 trillion VND and a post-tax profit of 49 billion VND in 2016, down 24.8 percent and 74 percent from 2015.

Among gainers, Hoang Huy Investment Services Corporation was able to increase its revenue by 71 percent to 1.04 trillion VND and profit by 147 percent to 201 billion VND.

However, those companies’ stocks have declined from their peak in January 2016.

Truong Long Auto and Technology JSC’s shares closed on February 23 at 51,000 VND per share, up 3 percent from 2016’s ending price. The company share, listed as HTL, has fallen more than 50 percent from last year’s highest price of 108,000 VND.

TMT Motors Corporation finished at 12,700 VND per share on February, down nearly three-quarters from last year’s peak of 45,000 VND per share .

The shares of Hoang Huy Investment Services Corp have fallen more than 58 percent since its 2016’s high of 9,700 VND.

Market confidence remains positive for 2017.

Despite the challenges, there is still a bright future for the industry in 2017, according to VDSC.

The market demand will increase as customers are expected to change their types of transportation on higher average income, VDSC said.

Vietnam’s per capita income was estimated to reach 5,668 USD in 2016, VDSC said, adding that some statistics show a higher demand for car ownership when a per capita income exceed 4,000 USD.

“Vietnam’s automobile retail industry is now in its preliminary stage of motorisation,” VDSC said. “Though the growth rate of automobile sales is slowing down, the expected booming demand for cars in the country is still ahead.”

Vietnamese consumers have maintained high confidence in the last few quarters and this is also a driving factor for car consumption. Traffic infrastructure is not a major concern for buyers at the moment as Vietnam’s infrastructure rank was up from 93 in the 2015-16 ranking of the World Economic Forum to 89 in 2016-17.-VNA

VNA