Hanoi (VNA) – January saw the largest amount of investment capital poured into Vietnam’s stock market since the beginning of 2020 on the back of strong exchange traded fund (ETF) inflows, according to a report by SSI Securities Corporation.

Vietnam is Asia’s only stock market with non-stop capital injection over the last four week as it attracted more than 100 million USD last month thanks to massive ETF inflows, outweighing the net capital withdrawal of around 23.5 million USD, said SSI’s February strategic stock market report entitled “Co hoi trong bien dong” (Opportunity in volatility).

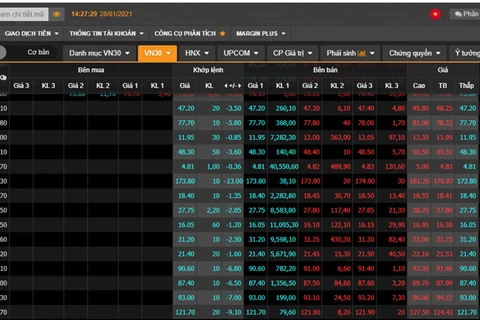

ETFs have also raked in about 129 million USD, or two third of the total inflows in 2020, mostly into VFM Diamond ETF (1.31 trillion VND or 57.15 million USD) and VFM VN30 ETF (860 billion VND).

The market also experienced strong foreign buying in the last three days of the month, raising foreign players’ net purchases of shares in January to about 127 billion VND.

SSI stated that Vietnam has become a quite attractive market largely owing to the country’s successful containment of COVID-19, positive economic growth and the fact that it remains a destination of the ongoing global production shift.

Though the pandemic has been a key contributor to the market volatility during this period of time, capital injection from ETFs into Vietnam remains a positive driver of the stock market, SSI said, adding that this also means increasing level of volatility.

According to the report, more than 81 billion USD was poured into stocks in both developed and emerging markets across the worrld last month, also with the domination of the ETFs./.

Vietnam is Asia’s only stock market with non-stop capital injection over the last four week as it attracted more than 100 million USD last month thanks to massive ETF inflows, outweighing the net capital withdrawal of around 23.5 million USD, said SSI’s February strategic stock market report entitled “Co hoi trong bien dong” (Opportunity in volatility).

ETFs have also raked in about 129 million USD, or two third of the total inflows in 2020, mostly into VFM Diamond ETF (1.31 trillion VND or 57.15 million USD) and VFM VN30 ETF (860 billion VND).

The market also experienced strong foreign buying in the last three days of the month, raising foreign players’ net purchases of shares in January to about 127 billion VND.

SSI stated that Vietnam has become a quite attractive market largely owing to the country’s successful containment of COVID-19, positive economic growth and the fact that it remains a destination of the ongoing global production shift.

Though the pandemic has been a key contributor to the market volatility during this period of time, capital injection from ETFs into Vietnam remains a positive driver of the stock market, SSI said, adding that this also means increasing level of volatility.

According to the report, more than 81 billion USD was poured into stocks in both developed and emerging markets across the worrld last month, also with the domination of the ETFs./.

VNA