Hanoi (VNA) – Once all conditions are met, Japanese firms can invest in the Vietnamese stock market, and some of its hot and newly listed stocks right from the IPO stage.

The seminar to launch the Japan International Cooperation Agency (JICA)’s

Addressing a seminar to launch the Japan International Cooperation Agency (JICA)’s

Technical Cooperation Project for “Capacity Building on Promoting Efficiency of Vietnamese Equity Market”, Kojima Kazunobu, JICA's Chief Consultant underlined that foreign investors, especially those from Japan, are paying great attention to the Vietnamese stock market.

Once large-scale and emerging companies raise capital through IPOs (initial public offerings) and listings, a large amount of foreign capital will flow into Vietnam, he said.

Kojima Kazunobu said that although the best opportunity for foreign investors to invest in Vietnam’s securities is to participate in IPOs, the current auction process makes it difficult for them. The number of companies undertaking IPOs and new listings on the Vietnamese stock market remains modest, he added.

The Japanese expert stressed the need for Vietnam to apply a new IPO method that is compatible with international standards, complete with underwriting and book building.

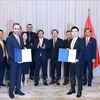

(Photo: VietnamPlus)

Kojima Kazunobu said that the “Capacity Building on Promoting Efficiency of Vietnamese Equity Market” project, jointly implemented by JICA and the State Securities Commission (SSC) of Vietnam, will focus on capacity building and promoting the efficiency of Vietnam's stock market.

It will concentrate on securities market surveillance and inspection, supervision of market intermediaries, listing and public offerings in line with international standards, and raising awareness on investor protection among listed companies.

This project follows JICA's "Project for Capacity Building on Improving Fairness and Transparency of Vietnamese Equity Market" implemented from 2019 to 2023. Under the project, “Strategy for the Development of Vietnam's Securities Market to 2030", the Government of Japan continues to support the efforts of the Government of Vietnam for further enhancement of the capacity and upgrade of the equity market for sustained socio-economic development. The new Project also enables the Vietnamese Securities Market to integrate into the ASEAN and international markets.

SSC Chairwoman Vu Thi Chan Phuong, said the Vietnamese stock market has recorded outstanding achievements on the back of various incentives and legal reform. As of the end of August, Vietnam's stock market capitalisation totalled over 7 quadrillion VND (280 billion USD), or 69% of the GDP in 2023 and up 19% from the end of the year.

Currently, there are 728 listed stocks and 878 shares on UPCoM with a total listed value of 2.24 quadrillion VND (91.27 billion USD), and foreign investors hold 50 billion USD, Phuong said, describing this as a demonstration of the robust development of the Vietnamese stock market./.