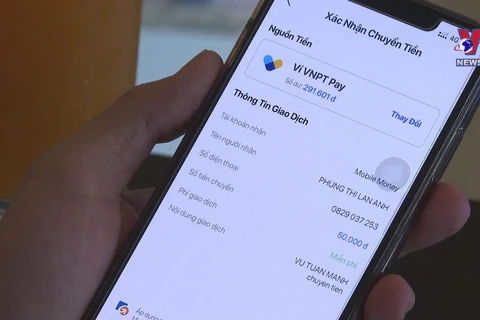

Mobile Money increases the access and use of financial services, especially in rural, mountainous, remote, border and islands of Việt Nam. (Photo: viettelstore.vn)

Mobile Money increases the access and use of financial services, especially in rural, mountainous, remote, border and islands of Việt Nam. (Photo: viettelstore.vn) Of which, the number of customers registering and using the service in rural, mountainous, remote, border and island areas is nearly 660,000, accounting for more than 60 percent.

The Lao Dong (Labourer) newspaper cooperated with the Payment Department under the State Bank of Vietnam and the Vietnam Telecommunications Authority under the Ministry of Information and Communications to organise a workshop on promoting the development of Mobile Money in Vietnam.

More than 3,000 business points accepting Mobile Money method have been established by the end of March. In which, the number of establishments in rural, remote, border and island areas is about 900, accounting for about 30 percent.

The total number of transactions using Mobile Money has reached more than 8.5 million with a total value of more than 370 billion VND (16 million USD).

Le Anh Dung, Deputy Director of the Payment Department, said that the pilot enterprises had achieved positive results and ensured safety after nearly six months of implementation, contributing to the development of non-cash payment activities, increasing the access and use of financial services, especially in rural, mountainous, remote, border and islands of Vietnam.

Dung assessed that the deployment of Mobile Money service had taken advantage of infrastructure and data and telecommunications networks, which has helped reduce social costs and expand cashless payment channels on mobile devices, bringing convenience to users and meetting the actual needs of people and society.

Truong Quang Viet, Deputy General Director of Viettel Digital Services Corporation, said that after two years of the COVID-19 pandemic, production and business activities encountered many difficulties, which makes the country realise more clearly than ever that the universalisation of digital payments is necessary.

The transition to the digital economy was a paramount task, he emphasised.

Regardless of internet connection or bank account, with just phone numbers, users across the country could make cashless transactions, extremely easily through a Mobile Money account, he said.

Especially, in the period of the new normal, Mobile Money plays an important role in expanding trade opportunities for everyone, bridging the geographical and technological gap.

Viet said that as 40 percent of Vietnamese people do not have a bank account, the deployment of Mobile Money also created favourable conditions for the Government to carry out support activities for disadvantaged groups, people in remote areas such as the disbursement of subsidies, social security funds and loans to facilitate economic development.

The representative from Viettel said that the benefits of Mobile Money to people were undeniable.

“However, for the first time officially being licensed in the Vietnamese market, Mobile Money has also posed a problem in changing people's spending and money use behaviour,” he said.

Việt suggested Vietnam should speed up disbursement activities, support production and business for disadvantaged groups and people in remote areas through Mobile Money, so that it would become both a method and a driving force to improve people's lives, stimulate use and bring mobile money closer to life.

Along with that, State management agencies also needed to provide orientations and work out support policies to build and further replicate non-cash payment models across the country, so all citizens soon access and accept digital payments as a familiar and convenient form of spending, he proposed.

Banks and carriers deploying Mobile Money should also continue to maintain and further promote cooperation, thereby bringing value to people when using digital payment utilities, noted Viet.

So that, all people in all regions of the country could receive more and more benefits from the cashless economy, which motivates them to use and gradually change spending habits in daily life, he added./.

VNA