Hanoi (VNS/VNA) - Allowing banks access to Vietnam’s population database has set the foundation for the banking sector to expand and provide digital services to more customers, as well as improve security, prevent fraud and identity theft, according to the State Bank of Vietnam's (SBV) Deputy Governor Pham Tien Dung.

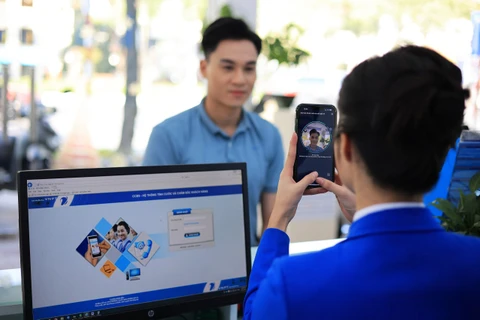

The central bank has already given the green light to commercial banks to roll out remote account opening using e-KYC, short for Electronic Know Your Customer, making many traditional banking services such as making deposits, loans and payments available digitally.

"Customer authentication and security are among the sector's most important priorities. Having access to the national database will allow credit institutes to verify and assess customers' credit rating, speeding up the lending process," he said.

Le Hoang Chinh Quang, deputy director of the SBV's IT Department, said the Ministry of Public Security (MPS) has started a campaign to tidy up and cross-reference 42 million customer profiles out of a total of 54 million registered.

The sector has been working in close collaboration with the ministry to expand the scope and depth of customer authentication solutions, using chip-embedded citizen ID cards and the VNeID app.

For example, more than 40 credit institutes have started the process to implement electronic identification and authentication using the ID cards while 10 have started with the app.

Quang said, however, that the process will likely take time as there are technical and administrative procedures to be resolved before a full implementation.

Electronic authentication and identification using citizen ID could save time for both banks and their customers while minimising the risk of document tampering and fraud, said industry experts.

Senior Lieutenant Colonel Cao Viet Hung from the MPS said the banking system has been a popular target for cybercriminals, who constantly try to seek and exploit security weaknesses and loopholes within the system in recent years.

For example, they could claim to be law enforcement officers from the police, the tax department and social insurance agencies to request victims to install dubious applications on their phones. Once ownership of their bank accounts was compromised, criminals could take over or steal their assets. Criminals could also create fake websites, and impersonate bank employees to swindle people.

In addition, there has been a surge of cases in which AI deepfakes were employed to mimic faces and voices of family members or friends to request money transfers in recent times.

The central bank has already given the green light to commercial banks to roll out remote account opening using e-KYC, short for Electronic Know Your Customer, making many traditional banking services such as making deposits, loans and payments available digitally.

"Customer authentication and security are among the sector's most important priorities. Having access to the national database will allow credit institutes to verify and assess customers' credit rating, speeding up the lending process," he said.

Le Hoang Chinh Quang, deputy director of the SBV's IT Department, said the Ministry of Public Security (MPS) has started a campaign to tidy up and cross-reference 42 million customer profiles out of a total of 54 million registered.

The sector has been working in close collaboration with the ministry to expand the scope and depth of customer authentication solutions, using chip-embedded citizen ID cards and the VNeID app.

For example, more than 40 credit institutes have started the process to implement electronic identification and authentication using the ID cards while 10 have started with the app.

Quang said, however, that the process will likely take time as there are technical and administrative procedures to be resolved before a full implementation.

Electronic authentication and identification using citizen ID could save time for both banks and their customers while minimising the risk of document tampering and fraud, said industry experts.

Senior Lieutenant Colonel Cao Viet Hung from the MPS said the banking system has been a popular target for cybercriminals, who constantly try to seek and exploit security weaknesses and loopholes within the system in recent years.

For example, they could claim to be law enforcement officers from the police, the tax department and social insurance agencies to request victims to install dubious applications on their phones. Once ownership of their bank accounts was compromised, criminals could take over or steal their assets. Criminals could also create fake websites, and impersonate bank employees to swindle people.

In addition, there has been a surge of cases in which AI deepfakes were employed to mimic faces and voices of family members or friends to request money transfers in recent times.

Hung said cybercriminals will likely continue to use more advanced technologies in the future to commit fraud.

He advised the sector to step up cooperation with the MPS, the SBV and payment companies to establish a coordinated procedure aimed at limiting unauthorised access to bank accounts and e-wallets, as well as to prevent the flow of funds in a timely manner.

The colonel stressed the importance of enhancing the sector's IT security. He said banks must take the initiative to clean up ghost accounts, often used for illegal activities, and severely sanction the buying and selling of customer data./.

He advised the sector to step up cooperation with the MPS, the SBV and payment companies to establish a coordinated procedure aimed at limiting unauthorised access to bank accounts and e-wallets, as well as to prevent the flow of funds in a timely manner.

The colonel stressed the importance of enhancing the sector's IT security. He said banks must take the initiative to clean up ghost accounts, often used for illegal activities, and severely sanction the buying and selling of customer data./.

VNA