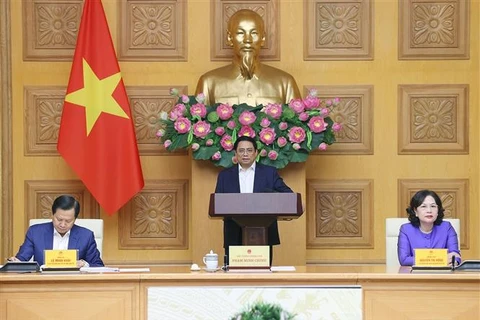

Hanoi ( VNA) - Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong has said the liquidity of the whole banking system has remained good.

The state bank is also willing to provide liquidity to credit institutions, especially at the end of the year when capital demand often peaks, Hong said.

The domestic monetary market last month saw complicated movements with deposit interest rates increasing significantly, hitting more than 10% per year at some banks.

According to Hong, in October, the market was mainly affected by psychological factors and complicated movements of the world economy. Under this context, the SBV promptly provided liquidity to support the banking system.

She said the SBV held an emergency meeting last week with credit institutions to discuss liquidity in the banking system. At the event, credit institutions agreed in the current context, they needed to strengthen their solidarity, trust and support for each other for the sake of ensuring the safety of both the entire banking system and each credit institution.

The central bank assessed that credit institutions have ensured operational safety indicators according to the SBV’s regulations. However, in order to actively respond to the complicated fluctuations of the global and domestic economy, credit institutions themselves found that it was necessary to review and evaluate more carefully to proactively have solutions to improve their performance and ensure the banking system is safe.

Hong said it is inevitable for Vietnam’s economy and currency to be affected by adverse impacts of the world market as the country has integrated deeply into the world economy. Vietnam, therefore, has to proactively deal with the fluctuations.

In fact, in 2022, under the direction of the Government and the Prime Minister, the SBV as well as other ministries and branches have taken proactive and flexible solutions to respond, which contributed to helping economic stability.

Under the current context, the Governor said the SBV as well as other ministries and branches need to strengthen forecasts, analysis and update new developments to proactively come up with timely and effective solutions.

Currently, the Government and the Prime Minister have been directing to accelerate the disbursement of public investment and implement expansionary fiscal policies, which will help ease pressure on the currency and credit of the banking system. The Government’s policies to enhance trade promotion to boost exports and promote foreign investment attraction are also expected to improve the supply and demand of foreign currencies as well as reduce pressure on the exchange rate.

“The market is now evolving in a positive way, and market sentiment is calm now,” Hong said.

According to the Governor, it is true that the monetary and foreign exchange markets are under pressure, but it is a common trend in many countries around the world, not just Vietnam. She noted it is important that Vietnam’s economic fundamentals remain very positive and international credit rating agencies, such as Fitch Ratings, have recently continued to affirm Vietnam’s long-term foreign-currency issuer default rating at 'BB' with a positive outlook.

“The SBV will actively supervise the actual situation to come up with suitable solutions in order to consistently achieve the goals of stabilising the macro-economy, controlling inflation and ensuring major balances of the economy and social security,” Hong said./.

Box: Credit ratings agency Fitch Ratings has affirmed Vietnam's long-term foreign-currency issuer default rating at 'BB' with a positive outlook.

In a commentary published on its website, Fitch Ratings said Vietnam's rating reflects its strong medium-term growth prospects, lower government debt compared to peers, and favourable external debt profile.

The agency expected a growth rate of 7.4% for Vietnam in 2022, led by strong gains in industry, construction and services. High FDI in manufacturing should continue to support robust growth in the medium term.

However, as downside risks remain, related to the economic implications of the Ukraine war and tighter global funding conditions, Fitch Ratings forecast a slowdown in GDP growth, to 6.2% in 2023.

According to the agency, the State Bank of Vietnam (SBV) has intervened in the foreign exchange market, which led to FX reserves falling to under 100 billion USD, after rising to a record 109.8 billion USD at the end of 2021./.