;Hanoi (VNA) – As of December 30, five out of the best growth stocks in Vietnam have seen increases of more than 1,000 percent in value, with one even reaching an over 2,000 percent rise.

The top-performing stock was ATA of Ntaco JSC with a value surge of 2,050 percent. It is being traded on the Unlisted Public Company Market (UpCoM) with total capitalisation worth more than 50 billion VND (2.19 million USD). From just 200 VND per unit at the beginning of 2021, ATA is now being traded at 4,300 VND per unit. Its value peaked on November 1 at 5,400 VND per unit.

However, there has been no transaction or if any, of small volume of the stock on the market.

ATA is followed by TGG of Louis Capital JSC (1,600 percent), PTO of Post And Telecommunication Services Construction Work Joint Stock Company (1,162 percent), RGC of PV - Inconess Investment Joint Stock Company (1,153 percent), NOS of Oriental Shipping and Trading JSC, LIC of LICOGI Corporation (1,100 percent), TNT of TNT Group JSC, LCM of Lao Cai Mineral Exploitation & Processing JSC, CMS of Construction and Manpower JSC, and KHB of Hoa Binh Minerals Joint Stock Company.

It is noteworthy that the consecutive surge of TGG and other stocks related to the Louis Holdings in August and September has triggered concern of investors. The State Securities Commission sent an inspection team to work with Louis Holdings in early October on the abnormal developments of those stocks.

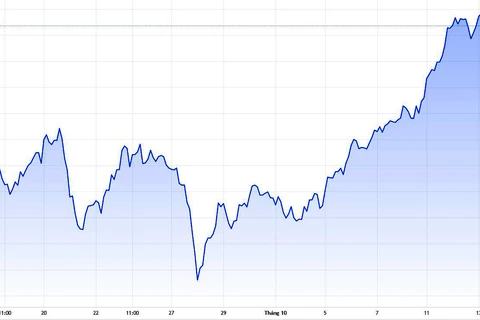

The stock market has set records in terms of scores, liquidity and the number of new accounts this year, as investors have seen it as a shelter amid complex developments of the COVID-19 pandemic.

Mirae Asset Securities (MAS) said in 2021, the VN-Index has successfully surpassed the 1,200 point mark and conquered the 1,500 point threshold, despite the economy experiencing two consecutive pandemic outbreaks.

Banking, real estate, materials, basic construction, financial services were the market leaders, contributing 31 percent, 23 percent, 15 percent, 10 percent, and 8 percent, respectively, to the growth of VN-Index.

The firm reported that by the end of November 2021, VN-Index increased by nearly 34 percent compared to 2020 and was named among the markets with the highest profitability in the world./.

VNA