Hanoi (VNS/VNA) - The launch of the Vietnam Semiconductor Innovation Network was big, but just the starting point of the country's ambition to stay at the forefront of the global chip supply chain.

"Vietnam will train 50,000 engineers between now and 2030 to embed itself further into the global chip supply chain," said Minister of Planning and Investment Nguyen Chi Dung at the launching event.

The minister promised more investment incentives and infrastructure for firms in the sector. While some facilities have been in place in the form of the National Innovation Center (NIC) and three high-tech parks, new ones are on the cards for inauguration.

The launch of a NIC training centre in Hoa Lac Hi-Tech Park last week speaks volumes about the country's effort to create an enabling environment for chip producers. The 41-million-USD facility comprises two office blocks and a conference hall, covering 20,000 sq.m of campus.

The Vietnam International Innovation Exhibition 2023 (VIIE 2023) was another event in the mix, where NIC signed deals with heavyweights like Google, Samsung, and Intel on innovation, talent pool, and research in the sector. VIIE 2023 also saw the entry into operation of the Samsung Innovation Campus and a chip design incubation centre initiated by Synopsys and NIC.

All those activities send a clear signal that Vietnam takes semiconductors seriously and is pressing ahead for the target of building its first chip-making plant by the end of the decade.

According to Tran Dang Hoa, Director of FPT Conductor JSC, semiconductor chips make their way from concept to consumers through three stages: designing, assembling, and packaging and testing.

He said Vietnam was well-positioned to play a role in all three stages. The country could gain the interest of foreign investors by offering more incentives related to power supply, land, and manpower.

"Vietnam is currently seen as a potential global chip producer, much like Taiwan in the past, which managed to build its world-class semiconductor sector from scratch," said Hoa.

The director also revealed that chips designed by his company were sent to the Repulic of Korea for assembling and then to Taiwan for packaging & testing, before being exported to customers in the US, Europe, and Japan.

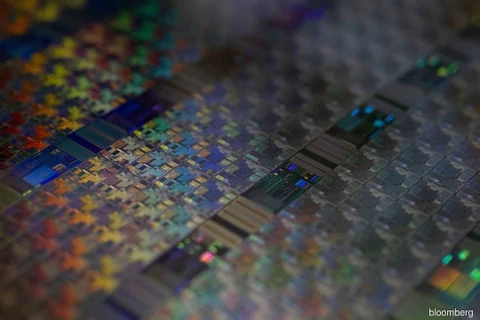

Bloomberg data showed that Vietnam's chip exports to the US increased from 312.7 million USD in February 2022 to 562.5 million USD in February 2023, accounting for 11.6% of the US chip imports, next to Malaysia (20%) and Taiwan (15.1%).

Vietnam's favourable environment for foreign investors has been the reason for tech giants locating their factories in the country.

Ten years ago, Intel opened its over-one-billion-dollar assembly and testing plant in Ho Chi Minh City. Now, Amkor Technology follows suit with another plant in Bac Ninh Province, which began operation last month.

Samsung also plans to begin making semiconductor parts in Vietnam. The production of its flip-chip ball grid array, a surface-mount packaging technology used for integrated circuits, is expected to kickstart later this year.

It is worth noting that Vietnam is rich in rare earth metals (REM), which play a vital role in chip manufacturing.

In her recent visit to Vietnam, Chief Economist of the US Department of State Emily Blanchard told Vietnam News that if Vietnam chooses to ask for US assistance in developing a REM auction, the US would be happy to provide the very assistance to do so.

"Technical assistance can extend to and often has support in helping craft tenders or bids to generate the most interest in a wide set of potential partner firms overseas," said the Chief Economist.

She also underlined the role of a skilled and trained workforce in semiconductor manufacturing. As such, workforce development is one of the places where the US seeks to partner with Vietnam's government to create economic opportunities for Vietnamese citizens to work in the sector.

Minister Dung believed that Vietnam would establish itself as a critical player in the global chip supply chain in the near future. He said Vietnam "can make it because the country has everything needed to develop its chip-manufacturing industry".

Market research conducted by Custom Market Insights in August showed that the global semiconductor chip market is expected to record a CAGR of 7.1% from 2023 to 2032. In 2022, the market size reached a valuation of 580.1 billion USD. The figure is anticipated to rise to 634.5 billion USD in 2023 and 1.1 trillion USD in 2032.

Meanwhile, the global semiconductor assembly and testing services market is forecast to reach a CAGR of 5.3% during the period. In 2023, the market size is projected to hit 38.1 billion USD./.

"Vietnam will train 50,000 engineers between now and 2030 to embed itself further into the global chip supply chain," said Minister of Planning and Investment Nguyen Chi Dung at the launching event.

The minister promised more investment incentives and infrastructure for firms in the sector. While some facilities have been in place in the form of the National Innovation Center (NIC) and three high-tech parks, new ones are on the cards for inauguration.

The launch of a NIC training centre in Hoa Lac Hi-Tech Park last week speaks volumes about the country's effort to create an enabling environment for chip producers. The 41-million-USD facility comprises two office blocks and a conference hall, covering 20,000 sq.m of campus.

The Vietnam International Innovation Exhibition 2023 (VIIE 2023) was another event in the mix, where NIC signed deals with heavyweights like Google, Samsung, and Intel on innovation, talent pool, and research in the sector. VIIE 2023 also saw the entry into operation of the Samsung Innovation Campus and a chip design incubation centre initiated by Synopsys and NIC.

All those activities send a clear signal that Vietnam takes semiconductors seriously and is pressing ahead for the target of building its first chip-making plant by the end of the decade.

According to Tran Dang Hoa, Director of FPT Conductor JSC, semiconductor chips make their way from concept to consumers through three stages: designing, assembling, and packaging and testing.

He said Vietnam was well-positioned to play a role in all three stages. The country could gain the interest of foreign investors by offering more incentives related to power supply, land, and manpower.

"Vietnam is currently seen as a potential global chip producer, much like Taiwan in the past, which managed to build its world-class semiconductor sector from scratch," said Hoa.

The director also revealed that chips designed by his company were sent to the Repulic of Korea for assembling and then to Taiwan for packaging & testing, before being exported to customers in the US, Europe, and Japan.

Bloomberg data showed that Vietnam's chip exports to the US increased from 312.7 million USD in February 2022 to 562.5 million USD in February 2023, accounting for 11.6% of the US chip imports, next to Malaysia (20%) and Taiwan (15.1%).

Vietnam's favourable environment for foreign investors has been the reason for tech giants locating their factories in the country.

Ten years ago, Intel opened its over-one-billion-dollar assembly and testing plant in Ho Chi Minh City. Now, Amkor Technology follows suit with another plant in Bac Ninh Province, which began operation last month.

Samsung also plans to begin making semiconductor parts in Vietnam. The production of its flip-chip ball grid array, a surface-mount packaging technology used for integrated circuits, is expected to kickstart later this year.

It is worth noting that Vietnam is rich in rare earth metals (REM), which play a vital role in chip manufacturing.

In her recent visit to Vietnam, Chief Economist of the US Department of State Emily Blanchard told Vietnam News that if Vietnam chooses to ask for US assistance in developing a REM auction, the US would be happy to provide the very assistance to do so.

"Technical assistance can extend to and often has support in helping craft tenders or bids to generate the most interest in a wide set of potential partner firms overseas," said the Chief Economist.

She also underlined the role of a skilled and trained workforce in semiconductor manufacturing. As such, workforce development is one of the places where the US seeks to partner with Vietnam's government to create economic opportunities for Vietnamese citizens to work in the sector.

Minister Dung believed that Vietnam would establish itself as a critical player in the global chip supply chain in the near future. He said Vietnam "can make it because the country has everything needed to develop its chip-manufacturing industry".

Market research conducted by Custom Market Insights in August showed that the global semiconductor chip market is expected to record a CAGR of 7.1% from 2023 to 2032. In 2022, the market size reached a valuation of 580.1 billion USD. The figure is anticipated to rise to 634.5 billion USD in 2023 and 1.1 trillion USD in 2032.

Meanwhile, the global semiconductor assembly and testing services market is forecast to reach a CAGR of 5.3% during the period. In 2023, the market size is projected to hit 38.1 billion USD./.

VNA