Hanoi (VNA) – Vietnam is among the world’s best performers in digital banking, with around 15 trillion VND (631.18 million USD) in total poured into digital transformation, Le Anh Dung, Deputy Director of the State Bank of Vietnam (SBV)’s Payment Department, told a talk show on September 28.

Held by the Vietnam Government Portal (VGP), the televised event saw speakers discussing digital transformation in banking and ways to have all people use and benefit from digital banking services.

Banks have undergone digital transformation in a much shorter time frame in the wake of COVID-19, with both the sector and customers profiting greatly from the process, Dung said.

Secretary-General of the Vietnam Banks’ Association (VBA) Nguyen Quoc Hung said the banking industry is a pioneer in digital transformation. Many major banks, such as VP Bank, Techcombank, MB and HD Bank, have begun the process relatively early, reaping very encouraging results, he noted, adding that the Current Account Savings Account (CASA) has expanded 40 – 50%, resulting in a considerable surge in profit for the banks.

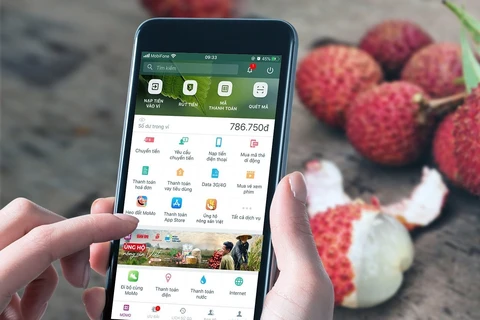

Televised by the Vietnam Government Portal (VGP), the talk show discusses digital transformation in banking in Vietnam. (Photo: VGP)

Televised by the Vietnam Government Portal (VGP), the talk show discusses digital transformation in banking in Vietnam. (Photo: VGP)

A survey by the SBV shows that 95% of the Vietnamese banks have developed a strategy for digital transformation and stayed active in adopting new technologies, including cloud computing and big data, in order to digitalise and upgrade its IT system and deliver better digital services, according to Dung.

Economist Dr. Pham Xuan Hoe highly spoke of the central bank’s efforts to push for the digital transformation progress, saying it has acted promptly to enhance regulatory framework, with the adoption of policies in payment intermediaries and credit cards, among others.

Citing the fact that 95% of payment and deposit transactions are made digitally, Hoe said that is why Vietnam, a developing country, has been regarded by a number of international organisations as one of the best performers in digital banking.

Speakers also exchanged views on challenges facing commercial banks both internally and externally./.

Held by the Vietnam Government Portal (VGP), the televised event saw speakers discussing digital transformation in banking and ways to have all people use and benefit from digital banking services.

Banks have undergone digital transformation in a much shorter time frame in the wake of COVID-19, with both the sector and customers profiting greatly from the process, Dung said.

Secretary-General of the Vietnam Banks’ Association (VBA) Nguyen Quoc Hung said the banking industry is a pioneer in digital transformation. Many major banks, such as VP Bank, Techcombank, MB and HD Bank, have begun the process relatively early, reaping very encouraging results, he noted, adding that the Current Account Savings Account (CASA) has expanded 40 – 50%, resulting in a considerable surge in profit for the banks.

Televised by the Vietnam Government Portal (VGP), the talk show discusses digital transformation in banking in Vietnam. (Photo: VGP)

Televised by the Vietnam Government Portal (VGP), the talk show discusses digital transformation in banking in Vietnam. (Photo: VGP)Economist Dr. Pham Xuan Hoe highly spoke of the central bank’s efforts to push for the digital transformation progress, saying it has acted promptly to enhance regulatory framework, with the adoption of policies in payment intermediaries and credit cards, among others.

Citing the fact that 95% of payment and deposit transactions are made digitally, Hoe said that is why Vietnam, a developing country, has been regarded by a number of international organisations as one of the best performers in digital banking.

Speakers also exchanged views on challenges facing commercial banks both internally and externally./.

VNA