Hanoi (VNA) - Vietnam has postponed a 3-billion USD international bond issuance plan due to unfavourable conditions in the global finance and monetary market, the finance ministry said.

The National Assembly in November last year approved the international bond issuance plan, to be launched in 2016, to restructure domestic debts that arise during the 2015-16 period. The bonds were expected to have terms of 10 to 30 years, with interest rates to be set depending on international capital market conditions at the time of issuance.

However, according to the finance ministry, the global finance and monetary market has continued to remain in a state of flux since the end of last year, with the period witnessing several unfavourable developments such as United States’ Treasury bond rise, China’s yuan devaluation and the Brexit vote.

The international bond issuance plan, therefore, has been postponed, the ministry said.

However, it said the Government will closely watch the global market in order to issue the bonds at a suitable time, ensuring national interests.

Vietnam has so far issued international bonds three times, the first of which was in 2005, worth 750 million USD; the second in 2010, valued at 1 billion USD; and the third in 2014, worth 1 billion USD.

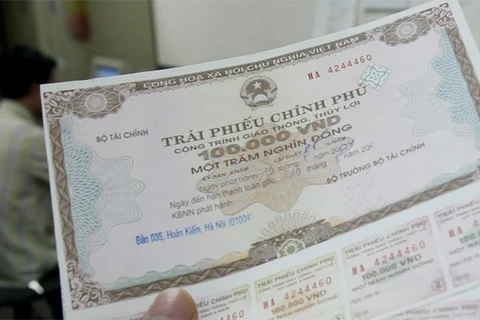

As for the domestic bond market, the Government issued 187.7 trillion VND in bonds in the first half of the year, nearly 86 percent of which were bonds with a term of five years or more.

The average term of the bonds during the period reached 6.8 years with an average interest rate of some 6.4 percent per year.

The State Treasury will issue another 40 trillion VND in Government bonds until the end of the year, chiefly those with terms of more than five years.-VNA

Five-year bond yield seen rising this year

Yields of Government bonds with terms five years or longer will likely rise this year, VPBank Securities said in a recent report.