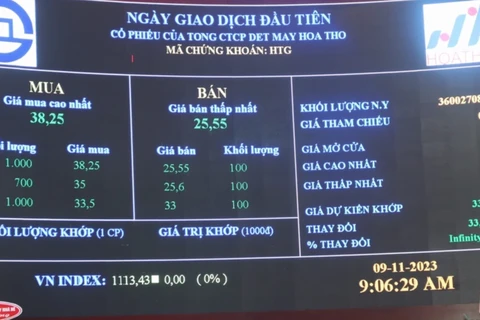

Investors look at digital boards displaying stock price movements at a securities company. (Photo: VNA)

Investors look at digital boards displaying stock price movements at a securities company. (Photo: VNA) His latest report Looking ahead at 2024 said last year, the stock market was driven higher - and then lower - by monetary policy, but the VN-Index finished the year up 12.2% in VND terms and 9.3% in US dollar terms.

“In 2024 we expect interest rates to remain stable and for investors to refocus on earnings growth and valuations, both of which should support an increase in stock prices.

“Specifically, we expect the earnings of Vietnam’s listed companies to recover from no growth in 2023 to 10-15% earnings growth in 2024, and our 2024 forecast is slightly below the current market consensus.

“Additionally, the market’s valuation is cheap and there are a few catalysts that could push it higher in early 2024.”

Installation of the new KRX trading system by the stock exchange in Q1 would help resolve certain technical problems, which in turn could lead to Vietnam being upgraded from a frontier market to an emerging market by FTSE-Russell later in the year.

Hopes were also high that a special session of the National Assembly in January would help fix some of the issues currently impeding real estate development.

The country’s economic growth and corporate earnings in H1, 2024, would both be flattered by the very low base last year.

GDP growth accelerated steadily throughout 2023, doubling from 3.3% year-on-year growth in Q1 to 6.7% in Q4.

“That acceleration is encouraging because the country’s economic recovery is gaining momentum and low growth numbers in early 2023 will also likely lead to encouraging news headlines about companies’ surging earnings, attracting investors’ attention to the stock market.”

Wide variation between sectors

VinaCapital expected a fairly wide dispersion in the performance of individual stocks and sectors.

For example, listed consumer companies’ earnings dropped by around 20% last year and were expected to surge by more than 30% in 2024 with the ongoing rebound in consumer spending.

“Likewise, the earnings of listed real estate developers (excluding Vinhomes) fell by around 50% last year, but we expect those companies’ earnings to surge by more than 100% this year driven by a modest pick-up in real estate development activity.”

Kokalari pointed out that the market’s overall valuation was already attractive at 10x forward P/E and 10-15% EPS growth.

Outperforming the overall stock market entailed savvy selection of sectors and individual stocks, and the company’s current preferred sectors included IT, selected banks, real estate developers (ex-Vinhomes), consumer discretionary companies, and securities companies.

After a challenging 2023 all indications are that 2024 should be a stronger year for Vietnam’s economy, driven by a rebound in manufacturing and improvement in consumer sentiment.

Besides, the steady fall in interest rates through 2023 should help boost the real estate market after having helped support the stock market last year.

The country’s GDP growth was expected to increase to 6-6.5% in 2024 from 5.1% last year.

The demand for “Made in Vietnam” products – especially consumer electronics – in the US/EU had already started to recover, and was likely to accelerate through 2024./.

VNA