Khanh Hoa (VNA) – Experts underscored the necessity and significance of the Finance and Disaster Risk Insurance Initiative within the framework of APEC at a seminar that concluded in Nha Trang city, the central province of Khanh Hoa on February 21.

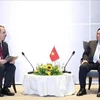

Organised by the National Institute for Finance, the Insurance Supervisory Agency and the Agency of Public Asset Management under the Finance Ministry, the event took place on the sidelines of the APEC Meeting of Deputy Finance Ministers and Vice Governors of Central Banks.

After hearing reports from representatives of APEC member economies and international organisations such as the World Bank and Organisation for Economic Cooperation and Development, experts presented a review of the one-year implementation of the initiative within the framework of the Cebu Action Plan.

According to them, insurance is an effective tool against disaster risks which eases the burden on state budgets, transfer risks to international markets and raises public awareness of disaster risks.

To develop disaster risk insurance market, APEC economies were advised to ramp up infrastructure and build models capable of forecasting natural disasters and possible losses caused by them.

Participants shared experience in devising financial strategies against disaster risks at national and local levels, saying that fine-tuning regulations and building a complete database on public assets and disaster risk insurance is needed.

On plans to realise the initiative, more focus will be given to building financial strategies and policies at national and local levels, financial risk management policies for public assets, policies for developing disaster risk insurance and analysis tools for financial policy planning in the field.

Several particpants shared view that the initiative should be brought to life via conferences and meetings of the APEC Meeting of Finance Ministers, training courses, exchanges of experts among member economies and technical assistance from international organisations.

On the occasion, the meeting discussed the priorities of the APEC Meeting of Deputy Finance Ministers and Vice Governors of Central Banks and plan for the APEC Finance Ministers’ Process.-VNA

Organised by the National Institute for Finance, the Insurance Supervisory Agency and the Agency of Public Asset Management under the Finance Ministry, the event took place on the sidelines of the APEC Meeting of Deputy Finance Ministers and Vice Governors of Central Banks.

After hearing reports from representatives of APEC member economies and international organisations such as the World Bank and Organisation for Economic Cooperation and Development, experts presented a review of the one-year implementation of the initiative within the framework of the Cebu Action Plan.

According to them, insurance is an effective tool against disaster risks which eases the burden on state budgets, transfer risks to international markets and raises public awareness of disaster risks.

To develop disaster risk insurance market, APEC economies were advised to ramp up infrastructure and build models capable of forecasting natural disasters and possible losses caused by them.

Participants shared experience in devising financial strategies against disaster risks at national and local levels, saying that fine-tuning regulations and building a complete database on public assets and disaster risk insurance is needed.

On plans to realise the initiative, more focus will be given to building financial strategies and policies at national and local levels, financial risk management policies for public assets, policies for developing disaster risk insurance and analysis tools for financial policy planning in the field.

Several particpants shared view that the initiative should be brought to life via conferences and meetings of the APEC Meeting of Finance Ministers, training courses, exchanges of experts among member economies and technical assistance from international organisations.

On the occasion, the meeting discussed the priorities of the APEC Meeting of Deputy Finance Ministers and Vice Governors of Central Banks and plan for the APEC Finance Ministers’ Process.-VNA

VNA