Hanoi (VNS/VNA) - Analysts of many foreign investment funds and local securities companies expect bank stocks will continue to record positive results in 2022.

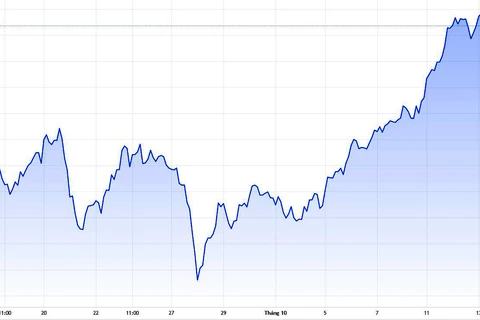

Bank stocks have been showing impressive performance in recent sessions, playing the role as the market’s leader while most other stock groups plummeted.

Foreign investment funds and securities companies are optimistic about the outlook of bank stocks in 2022.

In a recent report, foreign fund VinaCapital citing the latest survey results of the State Bank of Vietnam (SBV), said that in the fourth quarter of 2021, the bank business situation had significantly improved compared to the previous quarter. Banks also expect that their business situation will continue to improve further in the first quarter of 2022 and the whole of 2022.

"Credit risk is expected to decline slightly in 2022 compared to 2021. Therefore, we expect bank stocks to record positive results in 2022," VinaCapital said in the report.

Analysts from the MB Securities Company (MBS) also see promising growth of the banking industry after disruptions caused by the COVID-19 pandemic thanks to favourable macro factors such as rapid economic growth, a stable political situation and the participation in many free trade agreements.

In addition, asset quality continued to be improved because of the supportive policies of SBV and the proactive strategy in ensuring the asset quality of commercial banks. MBS also expects the bad debt ratio to improve in 2022, while the bad debt coverage ratio will to continue to be stable.

As the SBV continues to loosen monetary policy to maintain low interest rates, banks' profit picture is more positive this year.

Capital-raising activities are also one of the highlights of the industry in 2022, as a series of banks announced plans to sell capital to strategic shareholders such as VPBank or Orient Commercial Joint Stock Bank (OCB).

Meanwhile, Tran Thi Khanh Hien, Analysis Director of VNDirect Securities, said that the stock market still attracts domestic investors with a rising number of new accounts. And after realising the risk of investing in stocks that are advertised on online groups, investors will return to basic stocks with transparent information disclosure, and the banking industry will be in focus.

However, Hien said that the profit growth outlook in 2022 will be lower than in 2021 as banks have to balance risk control and expected profit to grow only 19 percent, which is lower than 2021.

According to the expert from VNDirect, raising capital, extending foreign room and changing trading exchanges are factors affecting bank stocks. In 2022, there will be no leading group and there will be divisions and unequal opportunities among bank stocks.

"And of course, bank stock prices are expected to witness strong divisions according to the profit growth rate and an individual story of each bank," said Hien.

Bullish business results

Ahead of the Tet holiday, many banks reported positive results in 2021 with optimistic goals, promising new breakthroughs this year.

In its fourth quarter business results, OCB said that the bank’s profit after tax rose 24.6 percent on-year to 4.4 trillion VND (194.6 million USD) in 2021.

Its return in equity (ROE) and return on assets (ROA) remained at high levels, which was 2.59 percent and 22 percent, respectively. OCB’s bad debt ratio was also under control, down 0.45 percentage points year-on-year to 0.97 percent.

The report showed that as of December 31, the bank’s total assets reached over 184.4 trillion VND, up 21 percent over the same period of 2020.

The results were thanks to comprehensive digitisation and effective control in operating costs.

Similarly, despite a challenging year due to COVID-19, Saigon Hanoi Commercial Joint Stock Bank (SHB) still recorded profit before tax of 6.2 trillion VND, up 90.3 percent over 2021, completing 107 percent of the whole year plan.

As of December 31, SHB's total assets reached 506.5 trillion VND, up 23 percent compared to the end of 2020. The bank’s charter capital was 26.67 trillion VND, completing the capital plan, while its own equity according to Basel II standards reached 53.2 trillion VND.

In addition, after strictly controlling operating costs, SHB’s cost to income ratio (CIR) edged down to 24.22 percent, making it one of the best cost control joint stock commercial banks. Its individual bad debt ratio was managed at 1.3 percent.

SeABank (SSB) saw an increase of 89 percent on-year in profit before tax to 3.3 trillion VND, exceeding 135 percent of the set plan thanks to diversification in sources of revenue and good management of operations.

As of December 31, SeAbank’s total assets increased by nearly 31.5 trillion VND compared to the same period of 2020 to 211.6 trillion VND./.

Bank stocks have been showing impressive performance in recent sessions, playing the role as the market’s leader while most other stock groups plummeted.

Foreign investment funds and securities companies are optimistic about the outlook of bank stocks in 2022.

In a recent report, foreign fund VinaCapital citing the latest survey results of the State Bank of Vietnam (SBV), said that in the fourth quarter of 2021, the bank business situation had significantly improved compared to the previous quarter. Banks also expect that their business situation will continue to improve further in the first quarter of 2022 and the whole of 2022.

"Credit risk is expected to decline slightly in 2022 compared to 2021. Therefore, we expect bank stocks to record positive results in 2022," VinaCapital said in the report.

Analysts from the MB Securities Company (MBS) also see promising growth of the banking industry after disruptions caused by the COVID-19 pandemic thanks to favourable macro factors such as rapid economic growth, a stable political situation and the participation in many free trade agreements.

In addition, asset quality continued to be improved because of the supportive policies of SBV and the proactive strategy in ensuring the asset quality of commercial banks. MBS also expects the bad debt ratio to improve in 2022, while the bad debt coverage ratio will to continue to be stable.

As the SBV continues to loosen monetary policy to maintain low interest rates, banks' profit picture is more positive this year.

Capital-raising activities are also one of the highlights of the industry in 2022, as a series of banks announced plans to sell capital to strategic shareholders such as VPBank or Orient Commercial Joint Stock Bank (OCB).

Meanwhile, Tran Thi Khanh Hien, Analysis Director of VNDirect Securities, said that the stock market still attracts domestic investors with a rising number of new accounts. And after realising the risk of investing in stocks that are advertised on online groups, investors will return to basic stocks with transparent information disclosure, and the banking industry will be in focus.

However, Hien said that the profit growth outlook in 2022 will be lower than in 2021 as banks have to balance risk control and expected profit to grow only 19 percent, which is lower than 2021.

According to the expert from VNDirect, raising capital, extending foreign room and changing trading exchanges are factors affecting bank stocks. In 2022, there will be no leading group and there will be divisions and unequal opportunities among bank stocks.

"And of course, bank stock prices are expected to witness strong divisions according to the profit growth rate and an individual story of each bank," said Hien.

Bullish business results

Ahead of the Tet holiday, many banks reported positive results in 2021 with optimistic goals, promising new breakthroughs this year.

In its fourth quarter business results, OCB said that the bank’s profit after tax rose 24.6 percent on-year to 4.4 trillion VND (194.6 million USD) in 2021.

Its return in equity (ROE) and return on assets (ROA) remained at high levels, which was 2.59 percent and 22 percent, respectively. OCB’s bad debt ratio was also under control, down 0.45 percentage points year-on-year to 0.97 percent.

The report showed that as of December 31, the bank’s total assets reached over 184.4 trillion VND, up 21 percent over the same period of 2020.

The results were thanks to comprehensive digitisation and effective control in operating costs.

Similarly, despite a challenging year due to COVID-19, Saigon Hanoi Commercial Joint Stock Bank (SHB) still recorded profit before tax of 6.2 trillion VND, up 90.3 percent over 2021, completing 107 percent of the whole year plan.

As of December 31, SHB's total assets reached 506.5 trillion VND, up 23 percent compared to the end of 2020. The bank’s charter capital was 26.67 trillion VND, completing the capital plan, while its own equity according to Basel II standards reached 53.2 trillion VND.

In addition, after strictly controlling operating costs, SHB’s cost to income ratio (CIR) edged down to 24.22 percent, making it one of the best cost control joint stock commercial banks. Its individual bad debt ratio was managed at 1.3 percent.

SeABank (SSB) saw an increase of 89 percent on-year in profit before tax to 3.3 trillion VND, exceeding 135 percent of the set plan thanks to diversification in sources of revenue and good management of operations.

As of December 31, SeAbank’s total assets increased by nearly 31.5 trillion VND compared to the same period of 2020 to 211.6 trillion VND./.

VNA