Hanoi (VNA) - The National Financial Supervisory Commission (NFSC) has reported that credit in the first month of the year saw a growth rate of 1 percent, the highest month-on-month increase over the past five years.

Credit in Vietnamese dong until January 31 rose by 1.6 percent from the figure at the beginning of the month, while credit in foreign currencies went up 1.6 percent in the same period.

In terms of credit structure, short-term lending accounted for 45 percent of total outstanding loan, while medium and long-term lending made up the rest. The proportion of credit in dong in the total outstanding loan remained at 91 percent, the same level as January 2016.

The high credit growth along with the 1.6 percent decrease in the month’s deposit (compared with the same period last year) made the average credit/deposit ratio increase to 88.2 percent from 86.8 percent of the end of last year.

In January, credit institutions experienced slight liquidity pressure, which was reflected in the overnight interest rate recorded at 5 percent per annum in the month. The rate reduced to 3.65 percent per annum by March 1.

The State Bank of Vietnam also had to inject more than 200.3 trillion VND (8.89 billion USD) via the Open Market Operation to support liquidity.

According to the commission, there was not much fluctuation in the deposit interest rates in January. However, the market still saw some banks offering interest rates for short-term dong deposits that were up by between 0.1 and 1.2 percentage points compared with the levels offered before Tet (New Lunar Year).

The commission attributed the increase in deposit interest rates partly to the regulation that the proportion of short-term loans used for medium and long-term lending must not exceed 50 percent. The regulation came into effect at the beginning of the year.

Meanwhile, lending interest rates were kept stable.

However, according to experts, interest rates are still under pressure.

The research group of the Bao Viet Securities Company predicted the deposit and lending interest rates this year would likely increase by 0.5-1 percentage per year.

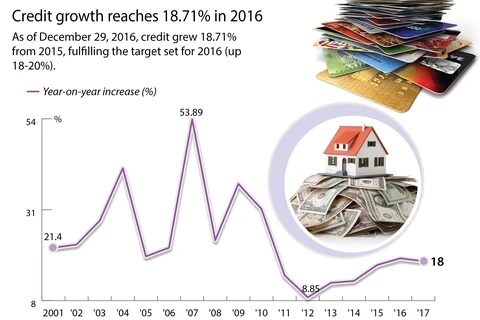

The prediction was made based on three factors. First, the credit would continue growing at high rates (at 17-18 percent) to support economic development. Second, inflation may also be on the rise, which makes nominal interest rate higher. Last, the US Fed is expected to make three more interest rate adjustments this year and the SBV must maintain a reasonable gap in the rates between the United States and Vietnam, which would put pressure on dong interest rates.

Nguyen Duc Do, deputy head of the Institute of Economics and Finance under the Academy of Finance, said bad debt is still an obstacle in the banks’ effort to reduce lending interest rates.

According to SBV, the Vietnam Asset Management Company will have to recover non-performing loans worth 190 trillion VND.-VNA

Credit in Vietnamese dong until January 31 rose by 1.6 percent from the figure at the beginning of the month, while credit in foreign currencies went up 1.6 percent in the same period.

In terms of credit structure, short-term lending accounted for 45 percent of total outstanding loan, while medium and long-term lending made up the rest. The proportion of credit in dong in the total outstanding loan remained at 91 percent, the same level as January 2016.

The high credit growth along with the 1.6 percent decrease in the month’s deposit (compared with the same period last year) made the average credit/deposit ratio increase to 88.2 percent from 86.8 percent of the end of last year.

In January, credit institutions experienced slight liquidity pressure, which was reflected in the overnight interest rate recorded at 5 percent per annum in the month. The rate reduced to 3.65 percent per annum by March 1.

The State Bank of Vietnam also had to inject more than 200.3 trillion VND (8.89 billion USD) via the Open Market Operation to support liquidity.

According to the commission, there was not much fluctuation in the deposit interest rates in January. However, the market still saw some banks offering interest rates for short-term dong deposits that were up by between 0.1 and 1.2 percentage points compared with the levels offered before Tet (New Lunar Year).

The commission attributed the increase in deposit interest rates partly to the regulation that the proportion of short-term loans used for medium and long-term lending must not exceed 50 percent. The regulation came into effect at the beginning of the year.

Meanwhile, lending interest rates were kept stable.

However, according to experts, interest rates are still under pressure.

The research group of the Bao Viet Securities Company predicted the deposit and lending interest rates this year would likely increase by 0.5-1 percentage per year.

The prediction was made based on three factors. First, the credit would continue growing at high rates (at 17-18 percent) to support economic development. Second, inflation may also be on the rise, which makes nominal interest rate higher. Last, the US Fed is expected to make three more interest rate adjustments this year and the SBV must maintain a reasonable gap in the rates between the United States and Vietnam, which would put pressure on dong interest rates.

Nguyen Duc Do, deputy head of the Institute of Economics and Finance under the Academy of Finance, said bad debt is still an obstacle in the banks’ effort to reduce lending interest rates.

According to SBV, the Vietnam Asset Management Company will have to recover non-performing loans worth 190 trillion VND.-VNA

VNA