Hanoi (VNA) – Vietnam’s tourism sector has benefited from the fourth Industrial Revolution, but experts held that if domestic travel firms fail to make full use of opportunities, they will lose the local market to foreign rivals.

The fourth Industrial Revolution has changed the world as well as people’s habits and thoughts of the values that were considered “unrealistic” in the past.Thanks to artificial intelligence (AI) applications and blockchain technology, the way people shop and entertain themselves has become different.

With the fast and giant steps of the world information technology, the tourism sector has benefited from defining new demands of the market. Over the years, a number of Vietnamese travel firms have strongly invested in technologies to avoid being lagged behind, but they still accepted the fact that the online tourism “cake” is being taken by foreign businesses.

Although the competitiveness index of Vietnam’s tourism sector has continuously advanced in the World Economic Forum’s ranking to the 63rd position out of 140 economies in 2019 from the 75th position out of 141 economies in 2015, the sector’s technological improvement has remained modest.

Nevertheless, online tourism sale platforms have been dominated by foreign giants.

Unexploited market

Reports from Google and Temasek showed that Vietnam’s online tourism market value in 2018 was 3.5 billion USD (up 15 percent), which is expected to reach 9 billion USD in 2025. Online tourism trend is changing rapidly.

Recently, only about 30 percent of tourists choose their tours in a traditional way, while 71 percent seek information about destinations on the Internet, and 64 percent book tours and buy online services for their Vietnam trips. Expert predicted that the figures will continue to rise in line with the growth of e-commerce and tourism.

Particularly, two out of 10 tourism trends recently is active tourism without depending on travel firms, with the support of smartphones.

Recognising the trend, more and more online travel agencies have been introduced, becoming a channel supporting tourists in seeking information, booking tickets and hotel rooms. However, statistics from the Vietnam E-Commerce Association showed that global firms like Agoda.com. Booking.com, Traveloka.com, and Expedia.com are dominating the Vietnamese market.

Not only have foreign visitors travelling to Vietnam used services from the firms, but domestic tourists have also been familiar to the foreign trading floors. Thus, domestic travel firms are losing right at their home ground.

“In fact, I can see big Vietnamese companies like Gotadi, Luxstay, Vntrip andVivavivu have been competed fiercely from foreign rivals, or bought by them, thus the ratio of Vietnamese capital in the apps become low at only about 10-20 percent,” said Tuan Ha, CEO of Vinalink, the founder of the Vietnamsurvey.com.

According to Ha, like Grab, its name sounds like a Southeast Asian firm, but the real boss is Softbank. In fact, only foreign giants are strong enough to invest dozens of billions USD for such platforms, Ha added.

Although Vietnamese companies like Tripi, Gotadi and Mytour.vn have tried to introduce apps allowing tourists to book hotel rooms, buy transport tickets, seek smart tours and travel information, but the efforts seem to be not enough.

Investment in technology: a drop in the ocean

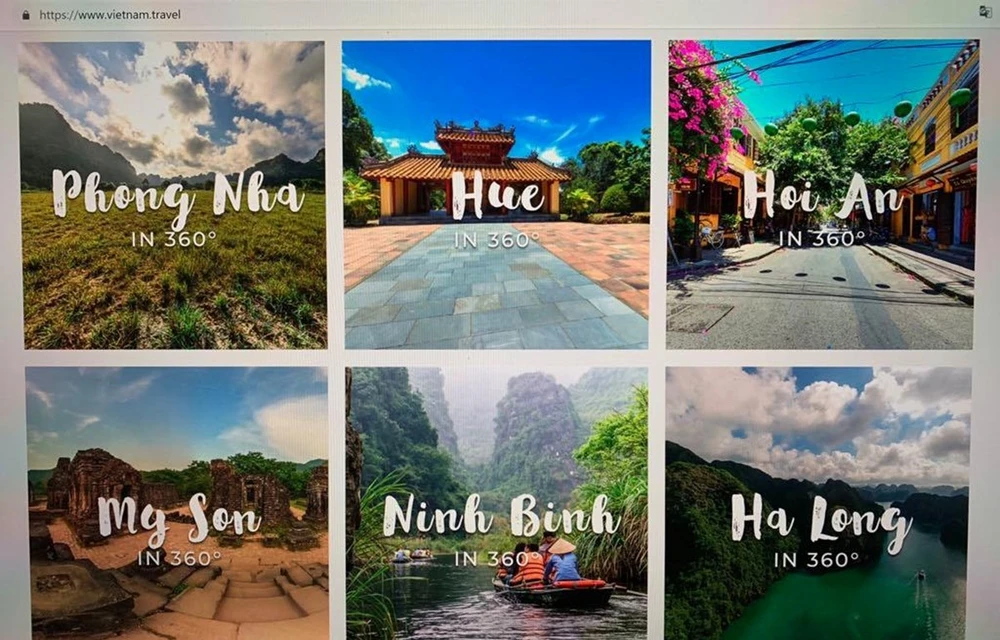

To meet the transaction and reaction demands, many mobile apps have been introduced, including virtual reality, augmented reality, and smart tourism.

However, only “giants” such as Saigontouristand Vietravel are strong enough to invest in such new solutions. Meanwhile, other firms like Hanoitourist, Transviet and Vietnamtourism are on the way to apply technologies in their business, making their websites more useful with diverse services. But the majority of the investment has remained modest.

At the same time, many travel firms have stopped at simple steps like designing their websites and linking to mobile apps. Due to a lack of investment, their websites often cause disappointment to customers.

The fact showed that it is time for travel companies to pay more attention to the application of technologies in their operations to avoid being lagged behind in the “game”./.