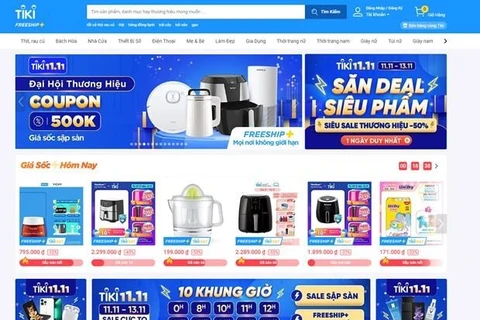

Vietnam currently has 139 e-commerce trading floor owners, with 41 sales floors and 98 service floors. (Photo: VNA)

Vietnam currently has 139 e-commerce trading floor owners, with 41 sales floors and 98 service floors. (Photo: VNA) Decree 91/2022/ND-CP amending and supplementing a number of articles of Decree 126 detailing the Law on Tax Administration has just been promulgated by the Government, effective from October 30.

Specifically, the new decree stipulates that the organisation that is the owner of an e-commerce floor is responsible for providing fully, accurately and on time to the tax agency information of traders, organisations or individuals that have conducted part or the whole process of buying and selling goods and services on the e-commerce trading floor.

This information includes the seller's name; tax identification number, personal identification number, identity card, citizen identification, passport, address; phone number; and sales through the floor's online ordering function.

The provision of information is carried out on a quarterly basis, no later than the last day of the first month of the following quarter.

E-commerce floors will provide required information through the Portal of the General Department of Taxation in the data format published by this agency.

Before that, the e-commerce floor was expected to pay taxes on behalf of sellers.

The recently released Vietnam E-commerce White Paper 2022 has forecast that the size of the Vietnamese retail e-commerce (B2C) market will reach 16.4 billion USD this year, up 20% over the previous year.

According to the General Department of Taxation, Vietnam currently has 139 e-commerce trading floor owners, in which, 41 sales floors, 98 service floors, and three partner companies of foreign suppliers are allowed to pay tax for organisations and individuals on behalf of foreign suppliers.

The average number of customers accessing the trading floors is estimated at 3.5 million times per day./.

VNA