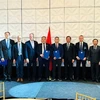

Ms. Stephanie von Friedeburg - Senior Vice President, Operations at IFC (second left) and Mr. Tran Hoai Nam - Deputy General Director of HDBank (first right) hand over the signing document under the witness of Vietnamese Prime Minister Pham Minh Chinh (second right) (Photo: Vietnamplus)

Ms. Stephanie von Friedeburg - Senior Vice President, Operations at IFC (second left) and Mr. Tran Hoai Nam - Deputy General Director of HDBank (first right) hand over the signing document under the witness of Vietnamese Prime Minister Pham Minh Chinh (second right) (Photo: Vietnamplus) The International Finance Corporation (IFC) and the Ho Chi Minh City Development Commercial Joint Stock Bank (HDBank) recently signed a memorandum of understanding to promote support for small and medium-sized enterprises (SMEs) with financial access and participation in global supply chains, including the high-tech agriculture chain.

The event took place on the occasion of the official visit to the US by Prime Minister Pham Minh Chinh who led a Vietnamese delegation to attend the US-ASEAN Special Summit in Washington D.C.

This strategic cooperation is expected to help HDBank build a supply chain finance (SCF) fund of up to 1 billion USD in the next 3 years, accordingly growing its SCF portfolio, currently active in construction materials, the agribusinesses sector, fast-moving consumer goods (FMCG) as well as supporting industries and downstream petroleum distribution.

IFC will assist HDBank in designing an SCF strategy for the agricultural sector, broaden its SCF products, and bring on board anchor firms along with their suppliers and distributors, among others.

"SCF that links buyers, suppliers, and financial institutions will efficiently support the trade cycles. IFC’s timely support will enable local businesses to leverage emerging trade opportunities and improve their linkages to formal supply chains, contributing to Vietnam's economic growth," said Pham Quoc Thanh, HDBank's CEO.

"Small and medium enterprises are the backbone of the economy and essential to Vietnam’s goal of becoming a manufacturing hub in the region," said Stephanie von Friedeburg, Senior Vice President, Operations at IFC.

"IFC’s support of domestic financial institutions like HDBank will contribute to increase SME linkages with the global supply chain and open up opportunities for development and job creation,” she added.

Previously, on April 14, IFC and HDBank inked a framework of Global Trade Finance Program (GTFP) to enhance financial capacity for Vietnamese SMEs, as well as enhance their engagement in the global supply chains.

In 2021, IFC provided a long-term loan of 70 million USD to HDBank to support renewable energy business.

Since Vietnam is accelerating the implementation of its growth strategy with the goal of reducing carbon emissions, the signing of building a supply chain finance for HDBank will help expand its portfolio of climate finance to 800 million USD by 2025, contributing to reducing emissions by more than 54,000 tons of carbon dioxide per year from 2021-2025 and beyond.

HDBank leaders said that in the future, the bank will consider climate finance as a development engine, especially when countries around the globe are attempting to adapt and mitigate the impacts of climate change and pursue sustainable economic growth.

IFC's long-term financing sources and expertise in combating climate change will help fuel the bank's ongoing efforts in a more inclusive approach, supporting the expansion of its climate finance portfolio by developing climate change related financial products and services with global best practices.

Also in 2021, IFC subscribed 95 million USD to international convertible bonds issued by HDBank to support increased lending to micro, small and medium enterprises.

Currently, the total value of commitments and cooperation between IFC and HDBank has reached more than 200 million USD, set to increase and develop in future./.