Jakarta (VNA) – Indonesia is likely to use up 8.3 million tonnes of palm oil to meet domestic demand for biodiesel this year, rising concerns there won’t be enough palm oil left to export, according to the Indonesian Palm Oil Association, or Gapki.

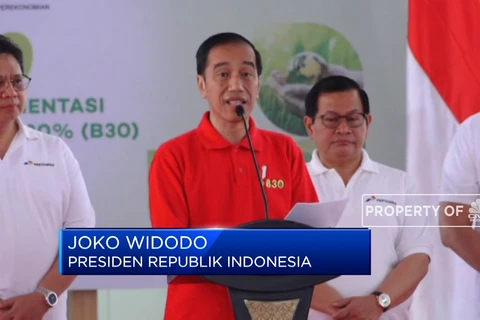

Last month, the Indonesian government began mandatory use of B30 – diesel fuel made up of 30 percent biofuel from palm oil and is already preparing to use the upgraded version, B40, next year.

The country’s demand for palm oil this year is estimated to reach 8.3 million tonnes, which will be processed into biodiesel, Gapki's executive director Mukti Sardjono said in a statement on earlier this week. It may reduce heavily the amount of palm oil available for export, he added.

Indonesia's crude palm oil and palm kernel oil production hit a record 51.8 million tonnes last year, up 9.1 percent from 2018, despite a long drought.

Despite the adverse effects of the US-China trade war, India's tariff discrimination and the European Union's biodiesel ban, exports still managed to gain 4 percent to 36.2 million tonnes.

Gapki estimated the export value of palm oil products, including oleochemicals and biodiesel, had declined to 19 billion USD last year, down 17 percent from 23 billion USD in 2018.

The decline in export value could have been more severe, but the crude palm oil (CPO) price recovered after President Joko Widodo announced in his state address that Indonesia would increase domestic use of CPO for biodiesel.

CPO price closed at 800 USD per tonne in Rotterdam port at the end of last year, almost twice the August price, as Indonesia began using the B30.

According to Gapki, the new coronavirus outbreak in China is likely to hamper Indonesia's palm oil exports there.

China was Indonesia's largest CPO and kernel palm oil market, buying a total of 6 million tonnes last year ahead of India (4.8 million tonnes) and the EU (4.6 million tonnes). China was also the biggest buyer of Indonesia's oleochemical and biodiesel products who purchased a total of 825,000 tonnes.

Mukti said he hopes the outbreak will not last too long since all export activities to China have been stopped temporarily.

Indonesia could still look forward to the increase in CPO demand in other markets like Africa, which imported 2.9 million tonnes of palm oil products last year, up 11 percent from 2018./.

VNA