Winners of the 2022 IR Awards as voted by investors in the large capitalisation stock category at a ceremony in HCM City on September 15.(Photo: VNA)

Winners of the 2022 IR Awards as voted by investors in the large capitalisation stock category at a ceremony in HCM City on September 15.(Photo: VNA) The annual awards seek to raise awareness of the role and importance of investor relation activities, promote information transparency in the stock market, improve the quality of information disclosed and investor confidence, said Nguyen Nhu Hung, editor-in-chief of the e-magazine.

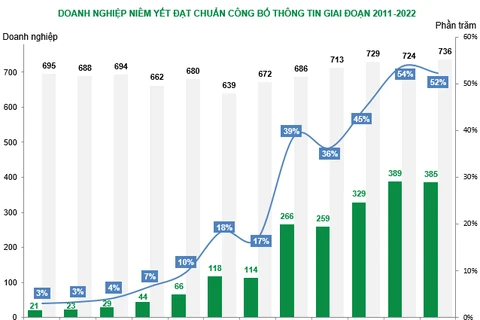

Hung said the awards are based on compliance with stock market information disclosure requirements by the 736 companies listed on the Ho Chi Minh Stock Exchange and Hanoi Stock Exchange, and 385 of them complied with all.

Then, based on their liquidity, compliance in terms of treasury stocks, foreign investment, and dividend payments, 45 were nominated for the awards.

In the final round, they were divided into three groups based on market capitalisation size (large, medium and small and micro-cap) and went through a rigorous assessment by 31 leading financial institutions and voting by investors based on three criteria: transparent and effective financial communication, reputation in the capital market and having IR activities that help optimise business value.

The top three voted by financial institutions were ACB, FPT, and MBBank (large-cap), Hai Phat Investment JSC, FPT Digital Retail JSC, and Digital World Co Ltd, (mid-cap), and Petrovietnam Securities Incorporated and Tan Cang Logistics & Stevedoring JSC (small and micro-cap).

The top three voted by investors were Mobile World Investment Corporation, FPT Corporation and Masan Group Corporation (large-cap), Digital World Co Ltd, FPT Digital Retail and Gia Lai Electricity JSC (mid-cap), and Petrovietnam Securities Incorporated, Everpia JSC and Tan Cang Logistics & Stevedoring JSC (small and micro-cap).

According to the organisers, for a second year the survey found more than 50% of listed companies meeting all disclosure requirements.

The high compliance rate is a good sign and indicates companies are paying attention to disclosure requirements, the basic requirement for treating investors fairly, they said./.

VNA