Hanoi (VNA) - Malaysia has successfully issued bonds worth 200 billion yen (1.8 billion USD), the first samurai bonds in 30 years and the largest sovereign bonds to be guaranteed by the Japan Bank for International Cooperation, the Finance Ministry said on March 8.

The 10-year bonds are priced at the full cost of 0.63 percent per annum, the ministry said in a statement.

Proceeds from the offering will be used for "general purposes," financing development expenditures such as building schools, hospitals, public roads and utilities.

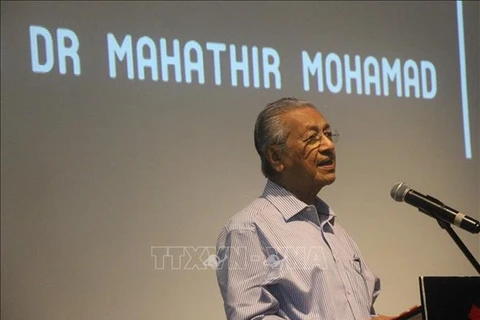

In November 2018, Malaysian Prime Minister Mahathir Mohamad said the money raised from the yen-denominated bond sale would be used to settle some old loans taken by the previous government to offset high borrowing costs.

Malaysia issued the last samurai bonds in 1989, during Mahathir's first turn as premier when he advocated the "Look East Policy" that drew massive Japanese investments into the emerging Southeast Asian country.-VNA

The 10-year bonds are priced at the full cost of 0.63 percent per annum, the ministry said in a statement.

Proceeds from the offering will be used for "general purposes," financing development expenditures such as building schools, hospitals, public roads and utilities.

In November 2018, Malaysian Prime Minister Mahathir Mohamad said the money raised from the yen-denominated bond sale would be used to settle some old loans taken by the previous government to offset high borrowing costs.

Malaysia issued the last samurai bonds in 1989, during Mahathir's first turn as premier when he advocated the "Look East Policy" that drew massive Japanese investments into the emerging Southeast Asian country.-VNA

VNA