Digital banking will play a major role in reducing operating costs and increasing the efficiency of banks’ cost-to-income ratio in 2019. (Source: TPBank )

Digital banking will play a major role in reducing operating costs and increasing the efficiency of banks’ cost-to-income ratio in 2019. (Source: TPBank )Hanoi (VNS/VNA) - Most banks will not officially set their annual targets until their shareholder meetings in April, but many bank leaders are optimistic about 2019 with plans to increase profits through cutting operating costs and promoting digital services.

Vietcombank has already set a 2019 pre-tax profit growth rate of 12 percent to over 20 trillion VND (855 million USD), while HDBank expects its pre-tax profit this year to rise by over 26 percent against 2018 to nearly 5.1 trillion VND.

Nguyen Dinh Thang, Chairman of Lien Viet Post Bank, expected with numerous major trade agreements that Vietnam has signed and are gradually taking effect, foreign capital would continue to flow strongly, facilitating domestic production and business activities.

Thang also expected major trade conflicts in the world would likely cool in 2019. Thang said that in 2019, if businesses and banks grasped their opportunities, the prospects for production and business would be better than 2018.

Nguyen Le Quoc Anh, General Director of Techcombank, expressed his optimism about 2019, saying even in the context of global fluctuations witnessed last year, Vietnam still achieved high GDP growth while internal factors and the resistance of the economy remained strong.

In 2019, when the central bank will continue tightening credit growth, banks plan to focus on reducing cost-to-income ratio (CIR) and promoting digital banking services.

After stepping through a peak period of investment to expand networks and workforces in the past two years, which has caused CIR to remain high, banks expect to gain from the investment in 2019.

Techcombank, VP Bank, TPBank and VIB have already managed to lower their CIR.

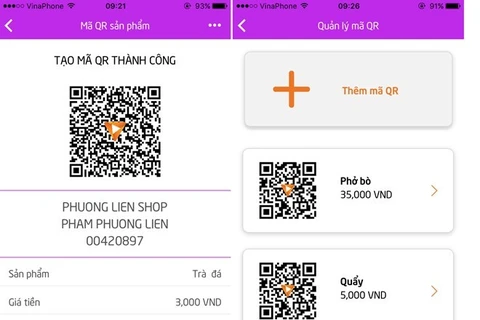

According to Do Minh Phu, Chairman of TPBank, digital banking would play a major role in reducing operating costs and increasing the efficiency of CIR, contributing to improve profits this year.

Phu analysed that the biggest costs in banking operations were the costs of network investment and development, along with the costs for personnel, which could be solved by the application of digital banking. Attracting customers to non-credit services and service fee collection was also becoming an increasing trend.

Sharing the same view, Nghiem Xuan Thanh, Chairman of Vietcombank, said that 2019 would be the year of digital banking. In the past three years, Vietcombank had focused on investment and implementation of a new core banking system to boost service development and shift the revenue structure instead of relying heavily on credit.

Developing digital banking combined with retail banking in a potential market of 95 million people with a high percentage of young people means commercial banks were quickly accumulating a customer base and large payment needs, Thanh said.

The focus on digital banking combined with retail banking has also helped some banks, Vietcombank, Techcombank and HDBank, to increase their number of individual customers rapidly in recent years, which has also contributed to raising the banks’ current account savings accounts (CASA) significantly.

Reports showed some banks last year raised CASA to 28-30 percent in the total structure of deposits. The large proportion of low-interest rate deposits has helped banks reduce mobilisation and operating costs, increasing profits and improving marginal interest in lending.-VNS/VNA

VNA