Hanoi (VNA) - Shares declined on the HCM Stock Exchange on the last four days this week, but strong demand from local traders cushioned the market.

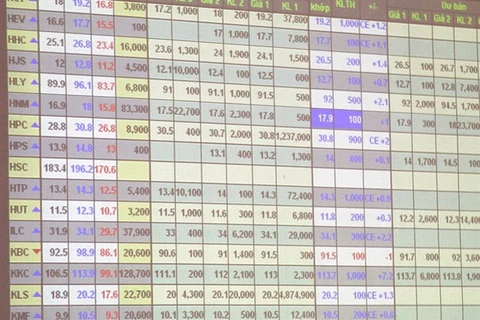

The benchmark VN-Index inched down 0.06 percent to 805.82 points on September 15. It expanded 1.1 percent in the last three sessions.

The market breadth was neutral with 130 stocks rising, 129 falling and 84 closing flat.

Two exchange-traded funds (ETF) – FTSE ETF and V.N.M ETF – concluded trading for their third-quarter portfolio restructuring and this had a negative effect on the market as many large-cap stocks were in the list for sale of these two funds.

Shares of Vietnam National Petroleum Group (PLX), Saigon Beer-Alcohol-Beverage (SAB) and budget airline Vietjet (VJC) were included in the FTSE Vietnam All-Share Index, but VJC closed unchanged while PLX and SAB decreased 0.15 percent and 0.18 percent, respectively.

Meanwhile, Hoa Binh Construction Group (HBC) was included in the V.N.M ETF’s portfolio, but edged up just 0.33 percent. FLC was removed from the fund’s basket this time and dropped 0.4 percent.

Other major stocks, although being increased or reduced weights in ETF’s portfolios, saw little changes. In recent years, ETF portfolio restructuring has not generated as great influence on the market as before.

Vinamilk (VNM), VinGroup (VIC) and Masan Group (MSN) dropped 0.2-0.5 percent while steelmaker Hoa Phat Group (HPG) and FLC Faros Construction (ROS) rose by less than 1 percent.

According to Vietnam Investment Securities Co, investors begin to pay attention to the stocks with promising business results in the third quarters.

“The company keeps a cautious view on the market outlook, but opportunities are open to individual stocks,” it said in a note.

Shares of real estate and securities companies attracted big money September 15 and most of them saw gains in value, including Saigon Securities Inc (SSI), HCM Securities (HCM), MB Securities (MBS), Novaland Investment Group (NVL), HCM City Infrastructure Investment, Dat Xanh Real Estate Service & Construction (DXG) and Dream House Investment (DRH).

On the Hanoi Stock Exchange, the HNX-Index maintained the uptrend, up 0.1 percent to end at 104.49 points. It inched down 0.05 percent on the previous day.

Liquidity changed little with a total of 218.3 million shares worth 4.8 trillion VND (211.4 million USD) in the two markets, down 6.3 percent in volume but up 6.7 percent in value compared to the previous session.

Foreign investors were net sellers on the two exchanges September 15, offloading shares worth a combined 293.6 billion VND.-VNA

The benchmark VN-Index inched down 0.06 percent to 805.82 points on September 15. It expanded 1.1 percent in the last three sessions.

The market breadth was neutral with 130 stocks rising, 129 falling and 84 closing flat.

Two exchange-traded funds (ETF) – FTSE ETF and V.N.M ETF – concluded trading for their third-quarter portfolio restructuring and this had a negative effect on the market as many large-cap stocks were in the list for sale of these two funds.

Shares of Vietnam National Petroleum Group (PLX), Saigon Beer-Alcohol-Beverage (SAB) and budget airline Vietjet (VJC) were included in the FTSE Vietnam All-Share Index, but VJC closed unchanged while PLX and SAB decreased 0.15 percent and 0.18 percent, respectively.

Meanwhile, Hoa Binh Construction Group (HBC) was included in the V.N.M ETF’s portfolio, but edged up just 0.33 percent. FLC was removed from the fund’s basket this time and dropped 0.4 percent.

Other major stocks, although being increased or reduced weights in ETF’s portfolios, saw little changes. In recent years, ETF portfolio restructuring has not generated as great influence on the market as before.

Vinamilk (VNM), VinGroup (VIC) and Masan Group (MSN) dropped 0.2-0.5 percent while steelmaker Hoa Phat Group (HPG) and FLC Faros Construction (ROS) rose by less than 1 percent.

According to Vietnam Investment Securities Co, investors begin to pay attention to the stocks with promising business results in the third quarters.

“The company keeps a cautious view on the market outlook, but opportunities are open to individual stocks,” it said in a note.

Shares of real estate and securities companies attracted big money September 15 and most of them saw gains in value, including Saigon Securities Inc (SSI), HCM Securities (HCM), MB Securities (MBS), Novaland Investment Group (NVL), HCM City Infrastructure Investment, Dat Xanh Real Estate Service & Construction (DXG) and Dream House Investment (DRH).

On the Hanoi Stock Exchange, the HNX-Index maintained the uptrend, up 0.1 percent to end at 104.49 points. It inched down 0.05 percent on the previous day.

Liquidity changed little with a total of 218.3 million shares worth 4.8 trillion VND (211.4 million USD) in the two markets, down 6.3 percent in volume but up 6.7 percent in value compared to the previous session.

Foreign investors were net sellers on the two exchanges September 15, offloading shares worth a combined 293.6 billion VND.-VNA

VNA