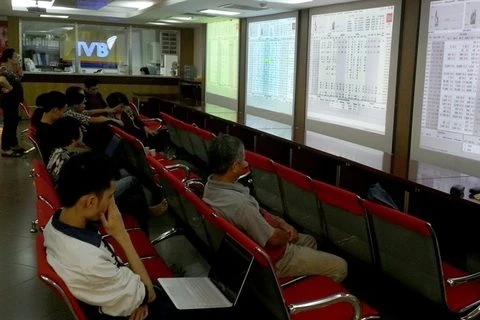

Hanoi (VNA) – The domestic stock market experienced positive developments in the first half of this year, with growth seen in both the VN-Index and HNX-Index.

The benchmark VN-Index rose 16.8 percent, from 664.87 points on January 3, to close at 776.47 points on June 30, a nine-year high. Meanwhile, the HNX-Index posted a higher growth rate of 23.7 percent, from 80.1 points to 99.1 points.

The highest growth was seen in the groups of stock companies, 47.1 percent; pharmaceutical firms, 38.8 percent; banks, 29.8 percent, and real estate developers, 20.8 percent, respectively.

Among brokerage firms, the biggest gainers were Saigon-Hanoi (SHS), 204 percent; HCM City Securities (HCM), 57.6 percent; and VNDirect Direct (VNA), 62.4 percent.

Trading liquidity recorded in the two markets between January-June averaged 4 trillion VND (175.9 million USD) in each session compared with 3 trillion VND (131.9 million USD) in 2016.

Foreign investors were also busy during the period, with net buy value of more than 9 trillion VND (395.9 million USD), a 16-year high, as against foreign net sale value of nearly 7 trillion VND (307.9 million USD) in 2016.

Foreign investments focused on construction, consumer goods and materials, with favourite shares being PLX, ROS, HPG, NVL and VNM.

Notably, foreign investors made net buying for 25 consecutive weeks.

Ngo The Hien, deputy head of market analysis at Sai Gon-Hanoi Securities Company (SHS), said the results are attributable to the Government’s efforts to improve the investment and business environment, macro-economic stability and good credit growth.

Economists said that macro-economic stability, curbed inflation, stable interest and forex rates, improved investment and business climate and positive signs in export and foreign investment would spur the market in the remaining of the year.

The State Bank of Vietnam recently shaved 0.25 percentage points off the annual refinancing interest rate. The ceiling annual short-term interest rate for loans in Vietnam dong in some sectors has also been cut by 0.5 percentage points.

On June 7, the National Assembly adopted a resolution on bad debt settlement, facilitating the process in commercial banks as well as handling bad debts in real estate.

According to Ha Quang Tuyen, head of the National Account Department under the General Statistics Office, more than 61,000 enterprises registered to establish in the first half of this year with total capital of 596 trillion VND (26.2 billion USD), up 12.4 percent in the number of enterprises and 39.4 percent in capital compared with the same period last year.

This is a huge resource spurring national growth, he said, noting that the growth target of 6.7 percent set for 2017 can be reached with due efforts. -VNA

The benchmark VN-Index rose 16.8 percent, from 664.87 points on January 3, to close at 776.47 points on June 30, a nine-year high. Meanwhile, the HNX-Index posted a higher growth rate of 23.7 percent, from 80.1 points to 99.1 points.

The highest growth was seen in the groups of stock companies, 47.1 percent; pharmaceutical firms, 38.8 percent; banks, 29.8 percent, and real estate developers, 20.8 percent, respectively.

Among brokerage firms, the biggest gainers were Saigon-Hanoi (SHS), 204 percent; HCM City Securities (HCM), 57.6 percent; and VNDirect Direct (VNA), 62.4 percent.

Trading liquidity recorded in the two markets between January-June averaged 4 trillion VND (175.9 million USD) in each session compared with 3 trillion VND (131.9 million USD) in 2016.

Foreign investors were also busy during the period, with net buy value of more than 9 trillion VND (395.9 million USD), a 16-year high, as against foreign net sale value of nearly 7 trillion VND (307.9 million USD) in 2016.

Foreign investments focused on construction, consumer goods and materials, with favourite shares being PLX, ROS, HPG, NVL and VNM.

Notably, foreign investors made net buying for 25 consecutive weeks.

Ngo The Hien, deputy head of market analysis at Sai Gon-Hanoi Securities Company (SHS), said the results are attributable to the Government’s efforts to improve the investment and business environment, macro-economic stability and good credit growth.

Economists said that macro-economic stability, curbed inflation, stable interest and forex rates, improved investment and business climate and positive signs in export and foreign investment would spur the market in the remaining of the year.

The State Bank of Vietnam recently shaved 0.25 percentage points off the annual refinancing interest rate. The ceiling annual short-term interest rate for loans in Vietnam dong in some sectors has also been cut by 0.5 percentage points.

On June 7, the National Assembly adopted a resolution on bad debt settlement, facilitating the process in commercial banks as well as handling bad debts in real estate.

According to Ha Quang Tuyen, head of the National Account Department under the General Statistics Office, more than 61,000 enterprises registered to establish in the first half of this year with total capital of 596 trillion VND (26.2 billion USD), up 12.4 percent in the number of enterprises and 39.4 percent in capital compared with the same period last year.

This is a huge resource spurring national growth, he said, noting that the growth target of 6.7 percent set for 2017 can be reached with due efforts. -VNA

VNA