Firm representatives fulfill procedures to pay taxes at the Ho Chi Minh City Tax Department. (Photo: nld.com.vn)

Firm representatives fulfill procedures to pay taxes at the Ho Chi Minh City Tax Department. (Photo: nld.com.vn) Hanoi (VNS/VNA) - After collecting 11.6 million USD from violations since early 2020, the General Department of Taxation (GDT) said it would reduce regular tax checks at businesses to help them focus on production to overcome the COVID-19 pandemic.

The GDT said it had collected more than 269 billion VND (11.6 million USD) from their recent inspections and examinations of 104 enterprises across the country. According to the tax officials, most of the violations were found in associated transactions and value added tax refunds.

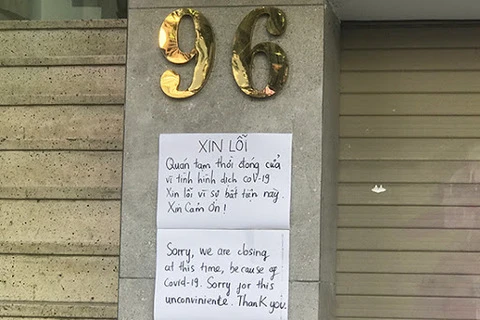

Although the inspection and examination work was still a concern, due to the difficulties amid the current COVID-19 pandemic, the GDT has instructed its tax departments to suspend planned inspections and examinations of many businesses.

A representative of GDT said: “To help reduce procedures, the tax department has stepped up inspections at the tax office instead of checking at places of business. Only when there are signs of tax risks, inspections and examinations will be conducted at the enterprise's headquarters.”

The report by the general department showed that as of July 15, 2020, the entire taxation sector has carried out 32,851 inspections, reaching 35.53 percent of the yearly plan and about 82.69 percent compared to the same period in 2019. The total amount collected was nearly 30.4 trillion VND and the total amount of tax paid to the state budget is more than 5.1 billion VND.

Tax extension

According to HCM City’s Tax Department, as of July 31, 2020, there were more than 28,000 businesses, organisations and nearly 24,500 business households and individuals that are subject to extensions of the tax payment time limit and land rent with a total tax of 8.8 trillion VND.

Of which, the value of added tax proposed for extension was 4.4 trillion VND, the corporate income tax proposed for extension was estimated at 3.55 trillion VND, the land rent proposed for extension was 684 billion VND, and for business households it was 166 billion VND.

HCM City’s Tax Department said many firms faced the double influence of COVID-19 and recent decree No 100 that clamped down on drunk driving in Vietnam.

In the first seven months of the year, the tax revenues on domestic and imported beer and wine, which accounted for more than 51 percent of the revenue of special consumption tax, was down nearly 15 percent, or more than 1 trillion VND over the same period. In the same period, the total special consumption tax collected decreased by nearly 11 percent from the same period last year.

The city tax office also said it had been minimising the number of inspections and examinations at businesses affected to help them focus on their production and business activities./.

VNA