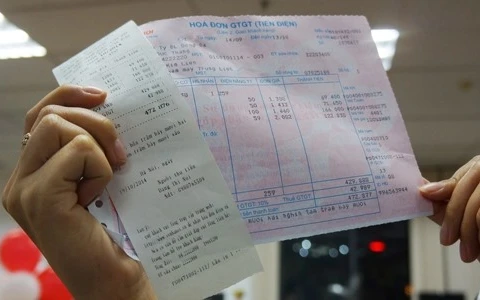

Application of modern payment methods like QR code, Tokenisation, mobile payment, and contactless payment will be expanded in the coming time. (Photo: SHB)

Application of modern payment methods like QR code, Tokenisation, mobile payment, and contactless payment will be expanded in the coming time. (Photo: SHB) Hanoi (VNA) – The State Bank of Vietnam (SBV) is working to complete the legal corridor and build rational mechanisms to boost cashless payments, which helps prevent corruption, money laundering, and tax invasion.

Cashless payments are on the rise

According to head of the SBV’s payment department Pham Tien Dung, Vietnam has leapfrogged Singapore and Malaysia in electronic payments.

Meanwhile, the Global Consumer Insights Survey 2019 by PwC, conducted in 27 territories and countries worldwide, have shown that the growth in the number of people making mobile payments in Vietnamese stores is at its fastest. The country’s mobile payments increased from 37 percent last year to 61 percent of digital payments in 2019.

The SBV said that in this year’s first quarter, the inter-bank system handles more than 37 million transactions worth nearly 21 quadrillion VND (898.42 billion USD), up 23 percent in the number of transactions and 17 percent in value, respectively from the same time last year.

Commercial banks have worked to integrate more functions on payments, enabling their customers to pay for all kinds of bills through their bank accounts. To date, there are 75 banks offering internet payment services, and 41 others providing mobile payment.

By the end of 2018, there were 18,587 ATMs, and 243,123 POSs across the country. Most of the machines are installed at shopping malls, supermarkets, convenience stores, restaurants, and hotels. Cashless payment services are being expanded to the public service sector via clinics, hospitals, and schools.

Cash still a preference

Experts have said that driving Vietnam towards an era of cashless payment is not an easy task, with local people’s habit of using cash, as well as poor infrastructure and connections between service suppliers and businesses billed as the main barriers.

Deputy General Director of Vietcombank Dao Minh Tuan said that among the 60 percent of the Vietnamese nationals who are allowed to open bank accounts, 80 percent of them prefer cash payments. Although more people shop online now, the cash on delivery (COD) method is still more widely favoured.

In addition, according to Tuan, many companies are reluctant to accept new payment modes while there is a shortage of policies and mechanisms to encourage cashless payments.

Technology standards, policy needed

Tuan suggested that along with developing technology standards to implement cashless payments, building a tax preference policy for businesses would work to ensure the country goes cashless.

Dung said that the SBV will expand the application of modern payment methods like QR code, Tokenisation, mobile payment, and contactless payment, among others.–VNA

VNA