Representatives from banks and companies are at the ceremony announcing top ten prestigious companies in banking, insurance and technology in Vietnam in 2023. (Photo: Vietnam Report JSC)

Representatives from banks and companies are at the ceremony announcing top ten prestigious companies in banking, insurance and technology in Vietnam in 2023. (Photo: Vietnam Report JSC) Hanoi (VNA) – The Vietnam Report JSC in collaboration with e-newpaper vietnamnet.vn on August 4 announced lists of the top 10 prestigious companies in banking, insurance and technology in Vietnam in 2023.

The ten banks honoured as the most prestigious commercial banks in the country in 2023 are Vietcombank, VietinBank, Techcombank, BIDV, Military Bank, VPBank, ACB, AgriBank, TPBank, and VIB.

Meanwhile, the ten most prestigious life insurance companies include Bao Viet Insurance, Dai-Ichi Vietnam, AIA Vietnam, Prudential Vietnam, Chubb Vietnam, Generali Vietnam, Hanwha Life Vietnam, Cathay Vietnam, MB Ageas and Mirae Asset Prévoir.

The top ten prestigious information technology - telecommunications companies include Military-run Industry and Telecoms Group (Viettel), FPT Corporation, Viet Nam Posts and Telecommunications Corporation, VNPT Vinaphone Corporation, Mobifone Corporation, CMC Corporation, VNPT-Vinaphone, Vietnam Technology and Telecommunication Joint Stock Company, Hanel Joint Stock Company, Việt Nam Technology & Telecommunication Joint Stock Company, Việt Nam Maritime Communication and Electronics Company, and Tien Phat Technology Joint Stock Company.

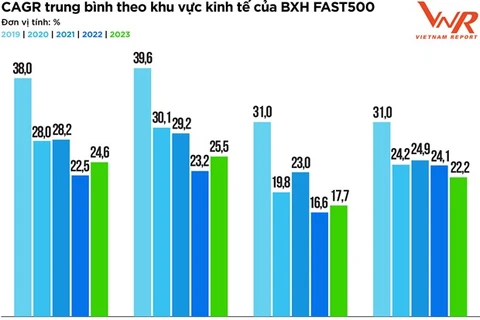

The annual rankings are based on independent research and assessment by Vietnam Report. The enterprises honoured in this year's lists are all effective, experienced, well-positioned and reputable representatives, making positive contributions to the overall development of the industry in particular and Vietnam’s economy in general in recent years.

According to a survey by Vietnam Report, banks do not expect breakthrough growth in the second half of 2023. The industry outlook is forecast to be stable, with a growth rate of between 42% and 44. 2% compared to the survey results in 2022 and 2021.

However, opportunities coming from the State Bank's new policies such as flexible interest rate management, closely following market developments, and global digital transformation are expected to bring great impetus for banks to overcome difficulties.

For the insurance industry, the "headwinds" in the market have had a strong impact on the industry in recent years, especially the series of cases related to insurance distribution channels through banks that have pulled down public confidence in the llife insurance market in particular and the insurance industry in general.

Meanwhile, the information technology - telecommunications industry has made progress and continued to be a bright spot in Vietnam's economy in 2022. But from the end of 2022 to the beginning of 2023, businesses in the industry are affected by the weak demand due to the risk of world economic recession and inflationary pressure.

To maintain growth in the current difficult context, businesses need to maintain their development goals, come up with balanced and comprehensive action strategies around technology and process issues and people such as improving competitiveness compared to other technology competitors, enhancing training of high-quality human resources./.