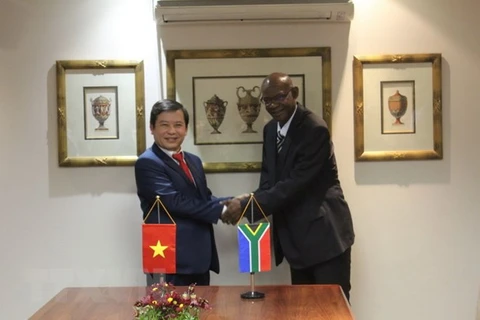

Pretoria (VNA) – A Vietnam – South Africa business dialogue took place in Cape Town, South Africa on March 13, part of the fourth Vietnam – South Africa inter-governmental partnership forum.

Speaking at the event, Deputy Foreign Minister Nguyen Quoc Cuong said he was impressed at the number of participants at the event, amounting to nearly 100 from Vietnamese and South African firms.

He attributed Vietnam’s attractiveness to foreign investors to its political and economic stability, integration into the world economy via bilateral and multilateral trade agreements and improving quality of workforce.

The Vietnamese government is striving to improve the business environment, cooperation and trade, he said.

According to him, two-way trade of more than 1 billion USD each year between Vietnam and South Africa remains modest compared to Vietnam’s total trade in goods and services worth 450 billion USD and South Africa’s 230 billion USD last year. Therefore, both countries should work harder to tap the potential of bilateral cooperation.

Director for South Asia, Central Asia and Southeast Asia at the South African Department of International Relations and Cooperation‘s Asia and the Middle East division Sindiswa Mququ said bilateral political ties have been growing and 25 years of diplomatic ties were marked in 2018.

As Vietnam has a trade surplus with South Africa, she called for narrowing trade balance between the two nations, adding that the Vietnamese and South African governments are willing to help businesses to boost cooperation and trade via legal frameworks and removal of barriers.

A representative from the Vietnamese Ministry of Industry and Trade briefed participants about Vietnam’s strengths and cooperation potential in agriculture, services, tourism and apparel.

Vietnamese enterprises introduced their signature products and sought partners from the host country.

Participants had a chance to enjoy Vietnamese coffee, coconut products and pepper.

Several South African firms expressed interest in Vietnamese farm produce and established contacts to boost trade.-VNA

Speaking at the event, Deputy Foreign Minister Nguyen Quoc Cuong said he was impressed at the number of participants at the event, amounting to nearly 100 from Vietnamese and South African firms.

He attributed Vietnam’s attractiveness to foreign investors to its political and economic stability, integration into the world economy via bilateral and multilateral trade agreements and improving quality of workforce.

The Vietnamese government is striving to improve the business environment, cooperation and trade, he said.

According to him, two-way trade of more than 1 billion USD each year between Vietnam and South Africa remains modest compared to Vietnam’s total trade in goods and services worth 450 billion USD and South Africa’s 230 billion USD last year. Therefore, both countries should work harder to tap the potential of bilateral cooperation.

Director for South Asia, Central Asia and Southeast Asia at the South African Department of International Relations and Cooperation‘s Asia and the Middle East division Sindiswa Mququ said bilateral political ties have been growing and 25 years of diplomatic ties were marked in 2018.

As Vietnam has a trade surplus with South Africa, she called for narrowing trade balance between the two nations, adding that the Vietnamese and South African governments are willing to help businesses to boost cooperation and trade via legal frameworks and removal of barriers.

A representative from the Vietnamese Ministry of Industry and Trade briefed participants about Vietnam’s strengths and cooperation potential in agriculture, services, tourism and apparel.

Vietnamese enterprises introduced their signature products and sought partners from the host country.

Participants had a chance to enjoy Vietnamese coffee, coconut products and pepper.

Several South African firms expressed interest in Vietnamese farm produce and established contacts to boost trade.-VNA

VNA