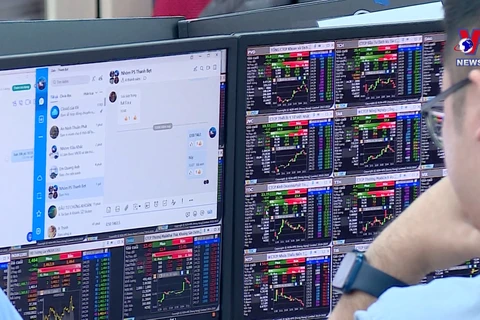

In 2023, Vietnam's stock market is still evaluated positively compared to markets in the region and the world. (Photo: Vietnam+)

In 2023, Vietnam's stock market is still evaluated positively compared to markets in the region and the world. (Photo: Vietnam+) International experts believe that 2024 is the right time for foreign investors to enter the Vietnamese stock market.

Recently, the US website CNBC quoted analysts predicting that Asia-Pacific’s top-performing markets in the first half of 2024 will be India, Japan and Vietnam.

According to CNBC, Vietnam expects to see a 6% to 6.5% GDP growth in 2024 on the back of robust imports and exports, as well as stronger performance of the manufacturing sector.

Positive signs in the Vietnamese market led to the increase in foreign direct investment (FDI) in 2023.

According to London-based LSEG data, 29 billion USD in FDI were pledged to Vietnam from January to November last year.

Investors should also be optimistic about Vietnam’s e-commerce sector, Tyler Nguyen, vice-president and head of institutional equity sales at Maybank Securities Vietnam said.

“We are seeing 20-30% year-on-year growth every year,” he told CNBC, pointing out that e-commerce accounts for only 2-3% of retail sales.

When asked about Vietnam’s possible entry into MSCI’s list of emerging market economies, Nguyen said the frontier economy was still “at a very nascent stage” but “we might see good news in 2025.”

Meanwhile, Mr. Andy Ho, chief investment officer of VinaCapital Group, told CNBC that now is the right time for investors who are interested in Vietnam’s stocks.

In comparison with peers in the region and the world, Vietnam’s stock market in 2023 was still evaluated rather positively.

The capitalization of Vietnam’s stock market approximated 6 quadrillion VND (246.7 billion USD) in 2023, rising 9.5% from and equivalent to about 62% of gross domestic product (GDP) in 2022.

The number of new investor accounts increased by over 350,000, bringing the total number to 7.4 million, equivalent to 7.5% of the country’s population.

Although the regional and global situations in 2024 are expected to be more complicated, Vietnam’s Deputy Minister of Finance, Nguyen Duc Chi, remains optimistic. He believes that with flexible management and important governmental measures set in 2023, the stock market will have the opportunity to grow both in size and quality, aiming for long-term sustainability in 2024 and beyond.

VN-Index is projected to have a good chance to surpass the 1,130-point threshold at the beginning of the new year, and advance towards the 1,150-point level, according to experts.

During the last trading week of 2023, the VN-Index displayed a series of recovery sessions, surpassing its previous peak of 1,130 points.

According to a report by Thailand’s investment bank Tisco, Vietnam’s stock market is currently attracting many foreign investors, and is expected to attract foreign capital flows worth 4 billion USD in 2024.

As a new player among emerging market bourses, Vietnam is expected to have a weight in the FTSE Emerging Markets Index of roughly 1%.

When the Vietnamese stock exchange becomes an emerging market, it aims to attract investments from foreign passive funds of up to 800 million USD, with five times more in foreign active funds, according to the report./.