Hanoi (VNA) – As many as 1.1 million people have so far used Mobile Money service, including nearly 660,000 in rural, mountainous, remote, border and island areas.

Ngo Dien Hy, Deputy General Director of the Vietnam Posts and Telecommunications Group (VNPT), said Mobile Money is an extension arm of the bank sector, enabling people in remote areas to access banking services.

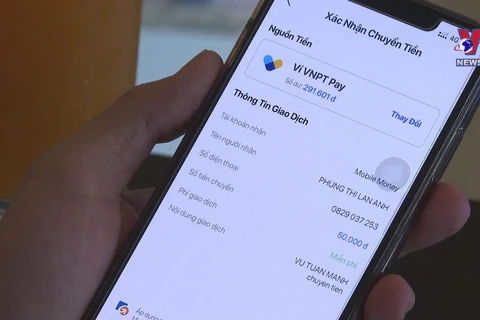

After six months of the pilot implementation, over 500,000 Mobile Money accounts were opened with 2,400 recharge points, 2,100 service payment acceptance points, mainly essential services such as electricity, water, public services, and tuition fee.

The VNPT has now partly achieved its initial expectation in deploying Mobile Money service, especially in approaching customers in new segments, Hy said.

Nguyen Dang Hung, Deputy General Director of the National Payment Corporation of Vietnam (NAPAS), said that the cooperation is likely to complete the connection between bank accounts and Mobile Money ones to the first telecommunications service provider in the third quarter of 2022.

According to Le Anh Dung, Deputy Director of the State Bank of Vietnam’s Payment Department, his agency will continue to coordinate with the Ministry of Information and Communications and the Ministry of Public Security to closely monitor and evaluate the pilot implementation of the Mobile Money service, and address relevant problems.

Dung said that Mobile Money will help strongly promote non-cash payment in rural, remote and border areas, and islands, contributing to creating a dynamic and inclusive payment ecosystem to serve people across the country.

Three mobile network operators - Viettel, VNPT and MobiFone – are providers of Mobile Money service. The service is expected to be a push towards cashless payment in Vietnam, a country where only 50 percent of the population have a bank account, and most people pay for goods valued at less than 100,000 VND (4.41 USD) in cash./.

Ngo Dien Hy, Deputy General Director of the Vietnam Posts and Telecommunications Group (VNPT), said Mobile Money is an extension arm of the bank sector, enabling people in remote areas to access banking services.

After six months of the pilot implementation, over 500,000 Mobile Money accounts were opened with 2,400 recharge points, 2,100 service payment acceptance points, mainly essential services such as electricity, water, public services, and tuition fee.

The VNPT has now partly achieved its initial expectation in deploying Mobile Money service, especially in approaching customers in new segments, Hy said.

Nguyen Dang Hung, Deputy General Director of the National Payment Corporation of Vietnam (NAPAS), said that the cooperation is likely to complete the connection between bank accounts and Mobile Money ones to the first telecommunications service provider in the third quarter of 2022.

According to Le Anh Dung, Deputy Director of the State Bank of Vietnam’s Payment Department, his agency will continue to coordinate with the Ministry of Information and Communications and the Ministry of Public Security to closely monitor and evaluate the pilot implementation of the Mobile Money service, and address relevant problems.

Dung said that Mobile Money will help strongly promote non-cash payment in rural, remote and border areas, and islands, contributing to creating a dynamic and inclusive payment ecosystem to serve people across the country.

Three mobile network operators - Viettel, VNPT and MobiFone – are providers of Mobile Money service. The service is expected to be a push towards cashless payment in Vietnam, a country where only 50 percent of the population have a bank account, and most people pay for goods valued at less than 100,000 VND (4.41 USD) in cash./.

VNA